EUR/USD Signal Update

Yesterday’s signal to go long at around 1.0760 was not trigged as there was no bullish price action when the price reached this level.

Today’s EUR/USD Signals

Risk 0.75%

Trades may only be entered between 8am and 5pm London time.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the first test of 1.0790.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

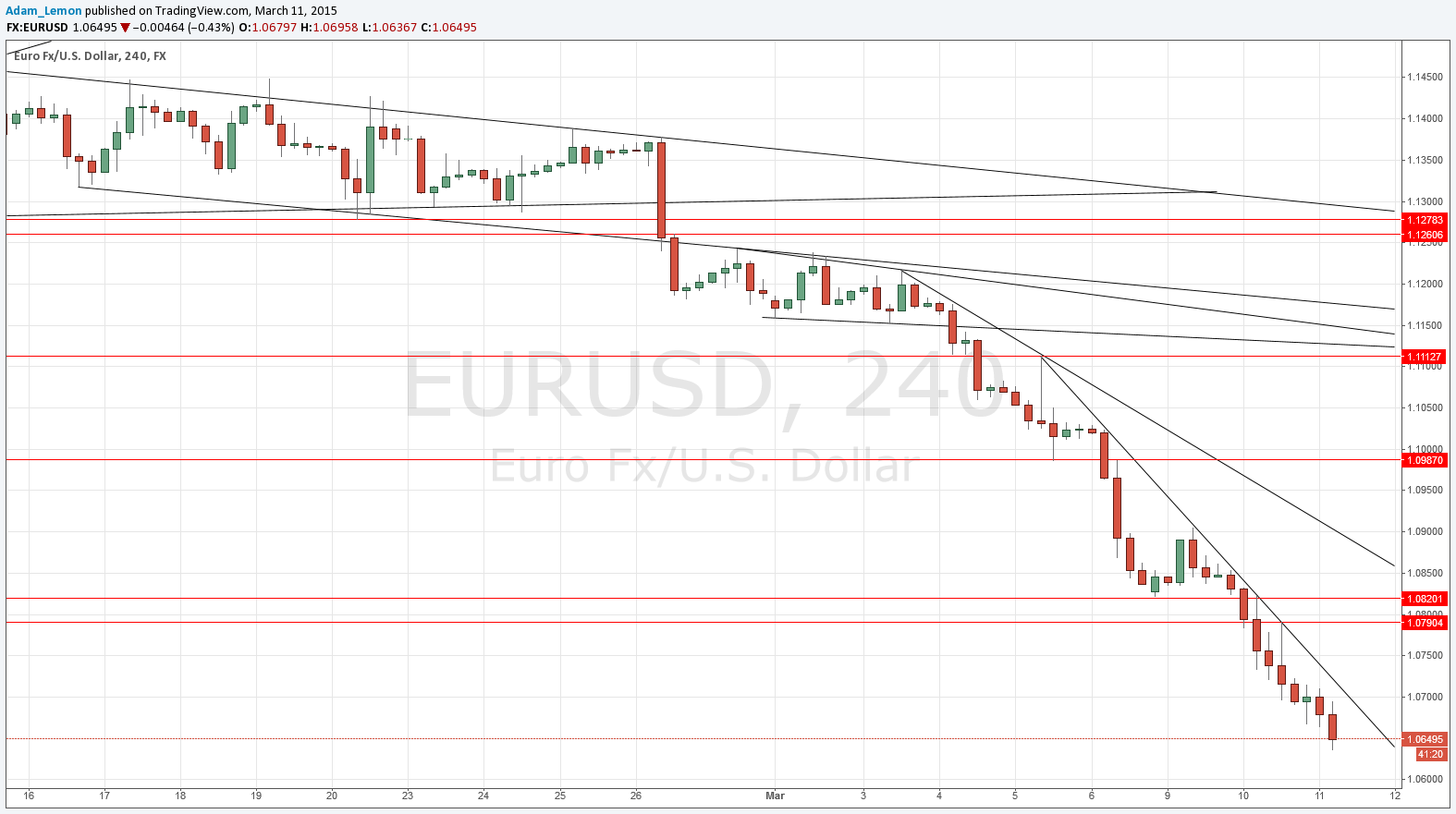

EUR/USD Analysis

I forecast yesterday that the pair was due a pull back and might bounce at around 1.0760 / 1.0760. The price did fall to reach this level very early in the London session, but there was only a very slight bounce, and no solid bullish price action on which to base a long trade. The pair continued to fall and has already broken below 1.0650 this morning.

There is no obvious support in sight and it would be foolish to try to call a bottom. However this pair is extremely oversold so a pull-back would not be surprising. The chart below shows the bearish trend lines have been steepening. When the nearest bearish trend line breaks to the upside and the price starts making higher lows on the shorter time frames, that will be a sign that a pull-back or consolidation phase might be beginning.

The nearest solid resistance is at 1.0790 which will probably be too far away to provide a short trade today.

I remain extremely bearish. My colleague Christopher Lewis sees the price going to 1.0500 and then proceeding to parity.

There are no high-impact events scheduled for today concerning the USD. Regarding the EUR, the President of the European Central Bank will be speaking at a minor conference at 8am London time.