EUR/USD Signal Update

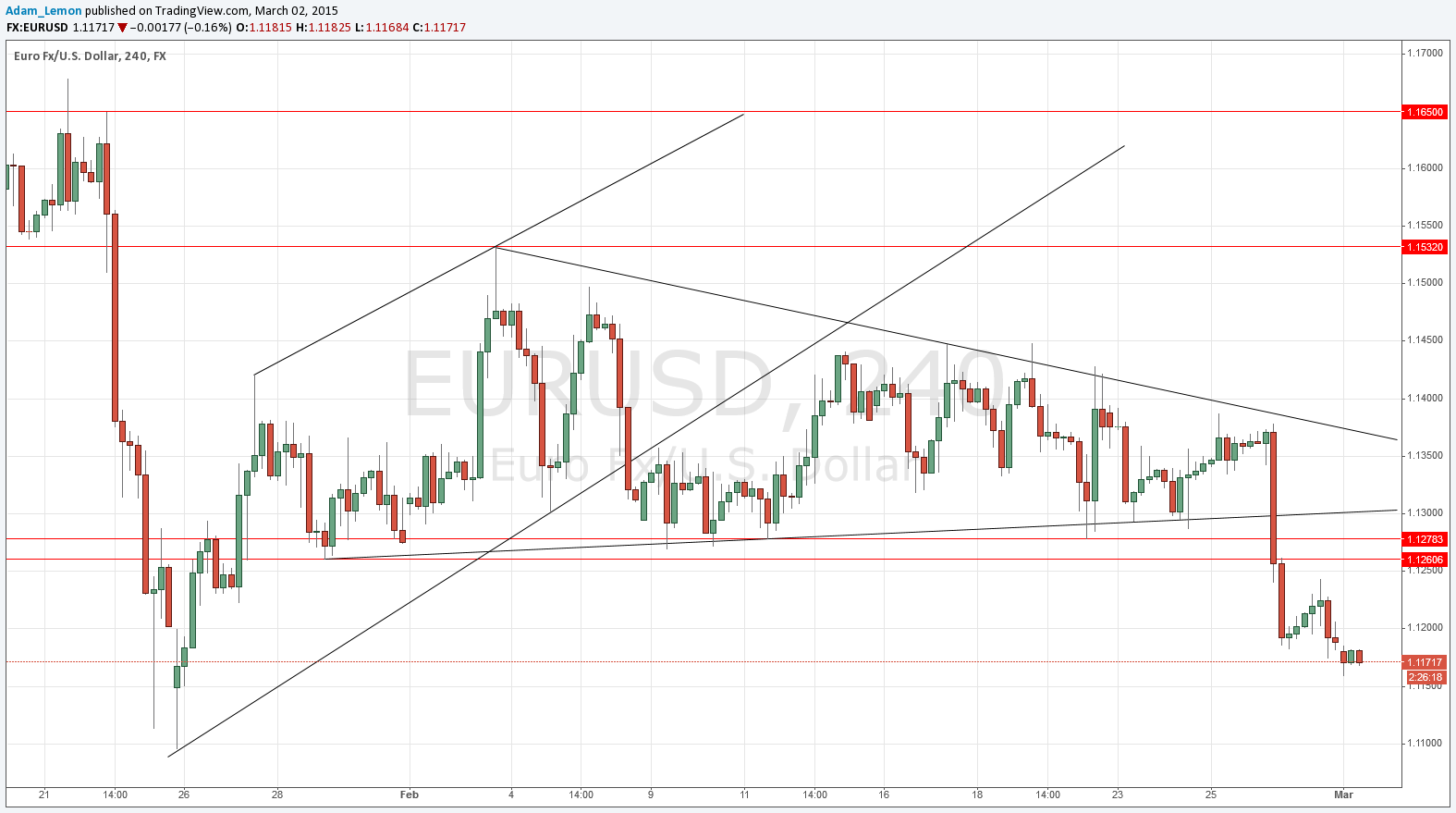

Last Thursday’s signals were not triggered as although we broke out of the triangle, we have not yet re-tested it.

Today’s EUR/USD Signals

Risk 0.75%

Trades may only be entered between 8am and 5pm London time only.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the first entry into the zone between 1.1260 and 1.1278.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

Short Trade 2

Go short following a bearish price action reversal on the H1 time frame immediately upon the first retest of the broken bullish trend line which is currently sitting at around 1.1300.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

EUR/USD Analysis

I forecast last Thursday morning that a breakout from the triangle was going to have to happen within the next week. We actually got the breakout downwards that very same day. The breakout was strong and never pulled back to the broken trend line, and has reached a low 140 pips below the breakout within two trading days. This is a fairly strong breakout for this pair.

There is an obvious flipped support to resistance zone above, and just below that there is the key psychological level of 1.1250 that the price could not quite reach on the first significant pull back to 1.1244 which happened on Friday, the day after the breakout. If this resistant area is broken soon it will suggest this move down is fake. It is also very important that we have no meaningful break above 1.1300 for this downwards move to remain healthily bearish.

There is likely to be support at 1.1100 and 1.1000 but I would not look to get long at these areas yet.

At 10am London time there will be a release of the CPI Flash Estimate for the Eurozone. Later at 3pm there will be a release of U.S. ISM Manufacturing PMI data.