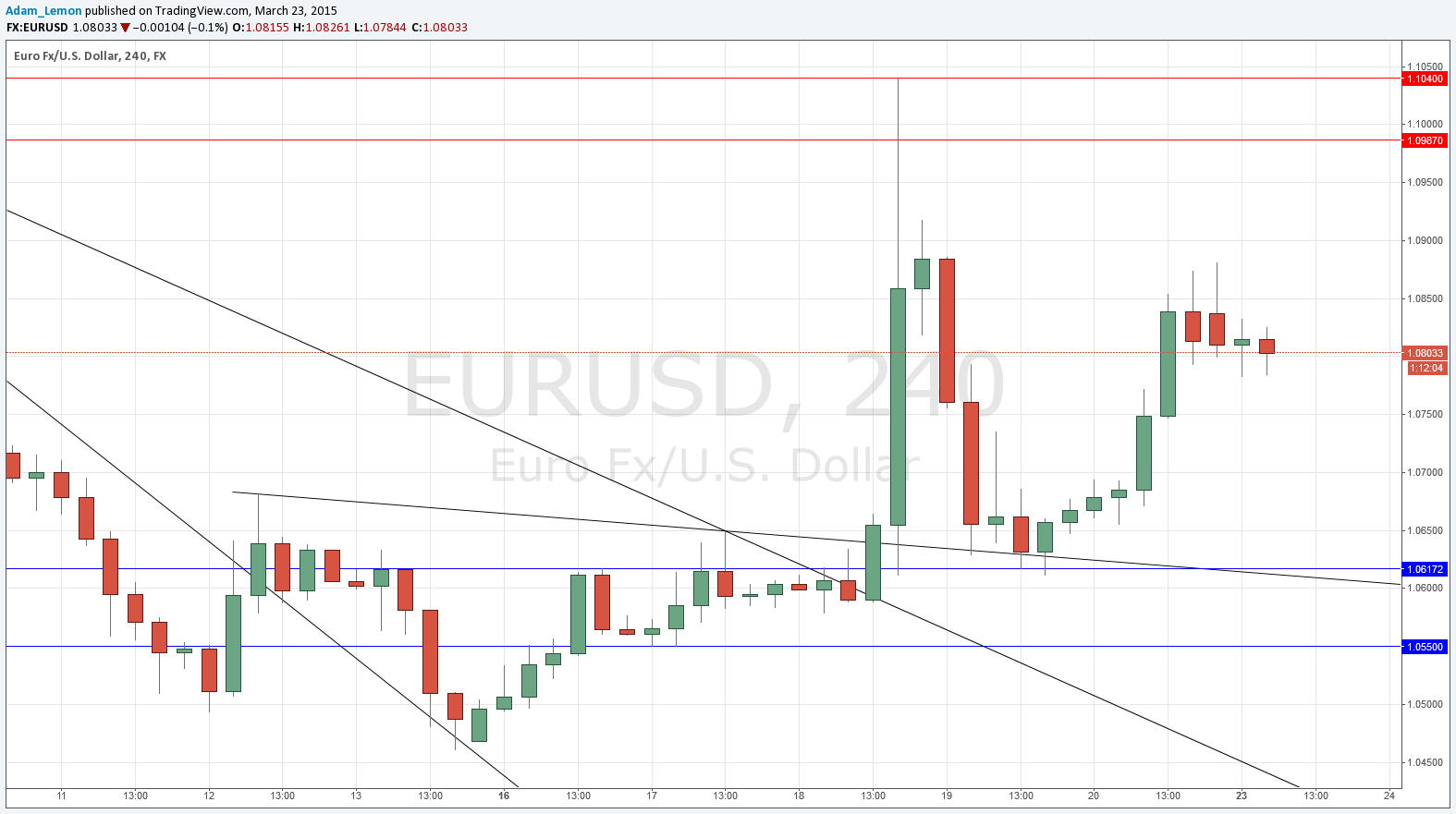

EUR/USD Signal Update

Last Thursday’s signal expired without being triggered as although the 1.0675 level was hit, there was no bullish price action reversal until the price had moved well below it.

Today’s EUR/USD Signals

Risk 0.75%

Trades may only be entered before 5pm London time.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the first test of 1.0617.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the first test of 1.0987.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

EUR/USD Analysis

The nearest levels where I would look for either long or short trades are a long way away from the current price, so it extremely unlikely that either level will be reached today.

I had expected that the most likely scenario was one in which the price found support at 1.0675 and then continued to move upwards. In fact, the price fell further, bouncing off an older, broken bearish trend line, before moving up to 1.0800 and beyond.

After the very large, fast swings that were made after the FOMC announcement, this pair is probably going to consolidate for a while. The broader picture shows a slackening in USD bullishness across the board, with signs that USD is strength is being eclipsed by the NZD and threatened by some other currencies over the medium term. However, the Euro remains relatively weak, so this will probably not be the best pair to trade for moves against the USD.

There are high-impact events scheduled today concerning the EUR, but nothing regarding the USD. At 2pm London time the President of the ECB will be testifying before the European Parliament. There will also be a meeting later today between Greek and German representatives over the Greek crisis.