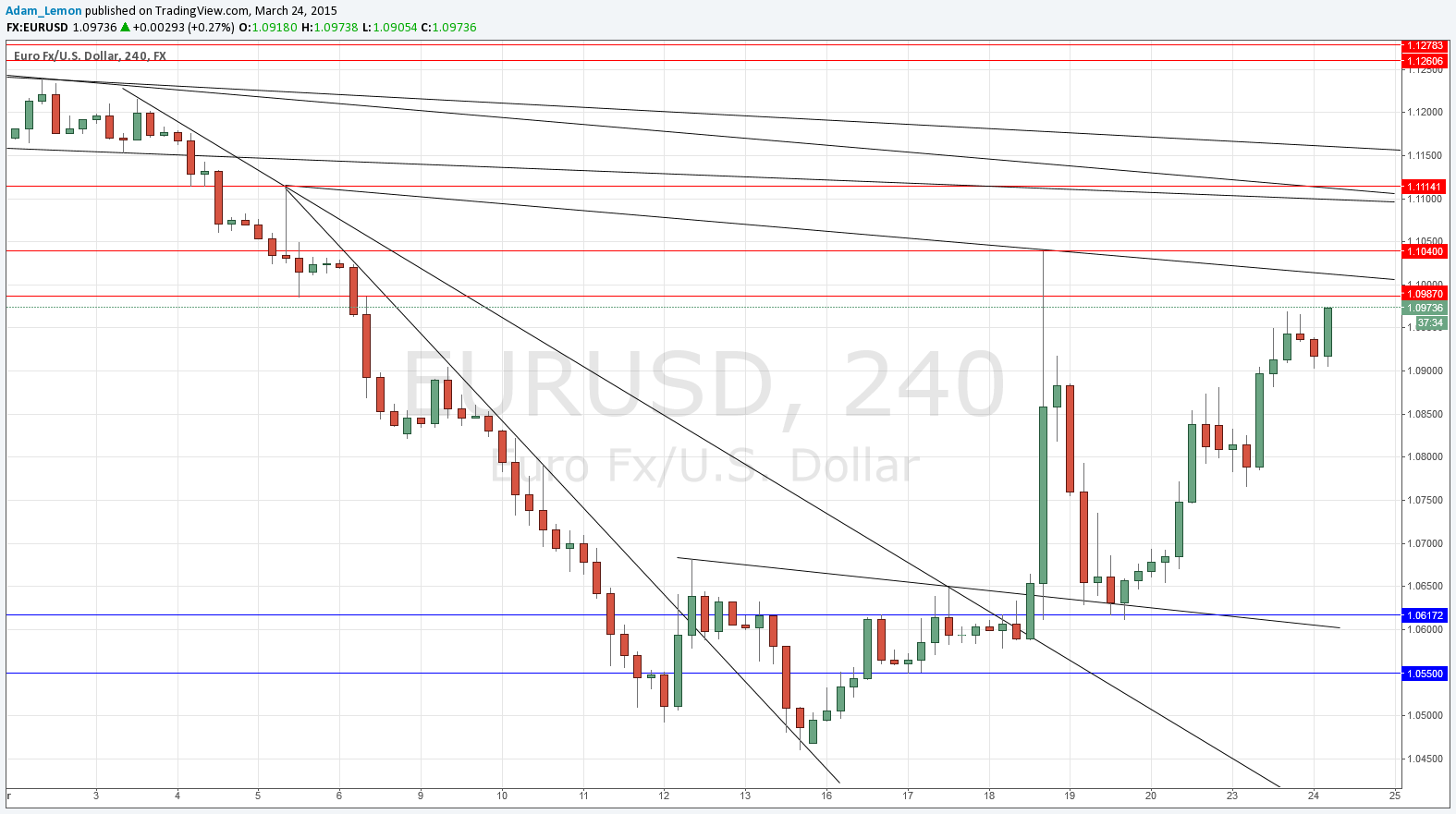

EUR/USD Signal Update

Yesterday’s signals were not triggered as the price never hit either 1.0617 or 1.0987.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be made between 8am and 5pm London time only.

Long Trade 1

Long entry following a bullish price action reversal on the H1 time frame immediately upon the first test of 1.0617.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the first test of 1.0987.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

EUR/USD Analysis

The Euro was the strongest currency over the day yesterday, and the USD was weak, so this pair continued its strong rise. At the time of writing, it is testing yesterday’s high, and we are not far from the resistant zone that should begin at around 1.0987. Above that level there are several confluent trend lines which should also add to the resistant nature of this area, and of course there is the psychological effect that the 1.1000 whole number is likely to exert. My colleague Christopher Lewis broadly agrees with this analysis.

A major bearish reversal is therefore potentially on the cards today. It is hard to see what except for short covering is fuelling the rise in the Euro. However there are a few news items due today that might push the price in any direction.

There are high-impact events scheduled today concerning both the EUR and the USD. At 8am London time there will be a release of French Flash Manufacturing PMI data followed half an hour later by German Flash Manufacturing PMI data. At 12:30pm there will be a release of U.S. CPI data followed at 2pm by New Homes Sales data.