EUR/USD Signal Update

Yesterday’s signals expired without being triggered.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be made before 5pm London time.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the first retest of the higher lower channel trend line currently sitting at around 1.1218.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

Go short following a bearish price action reversal on the H1 time frame immediately upon the first entry into the zone between 1.1260 and 1.1278.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

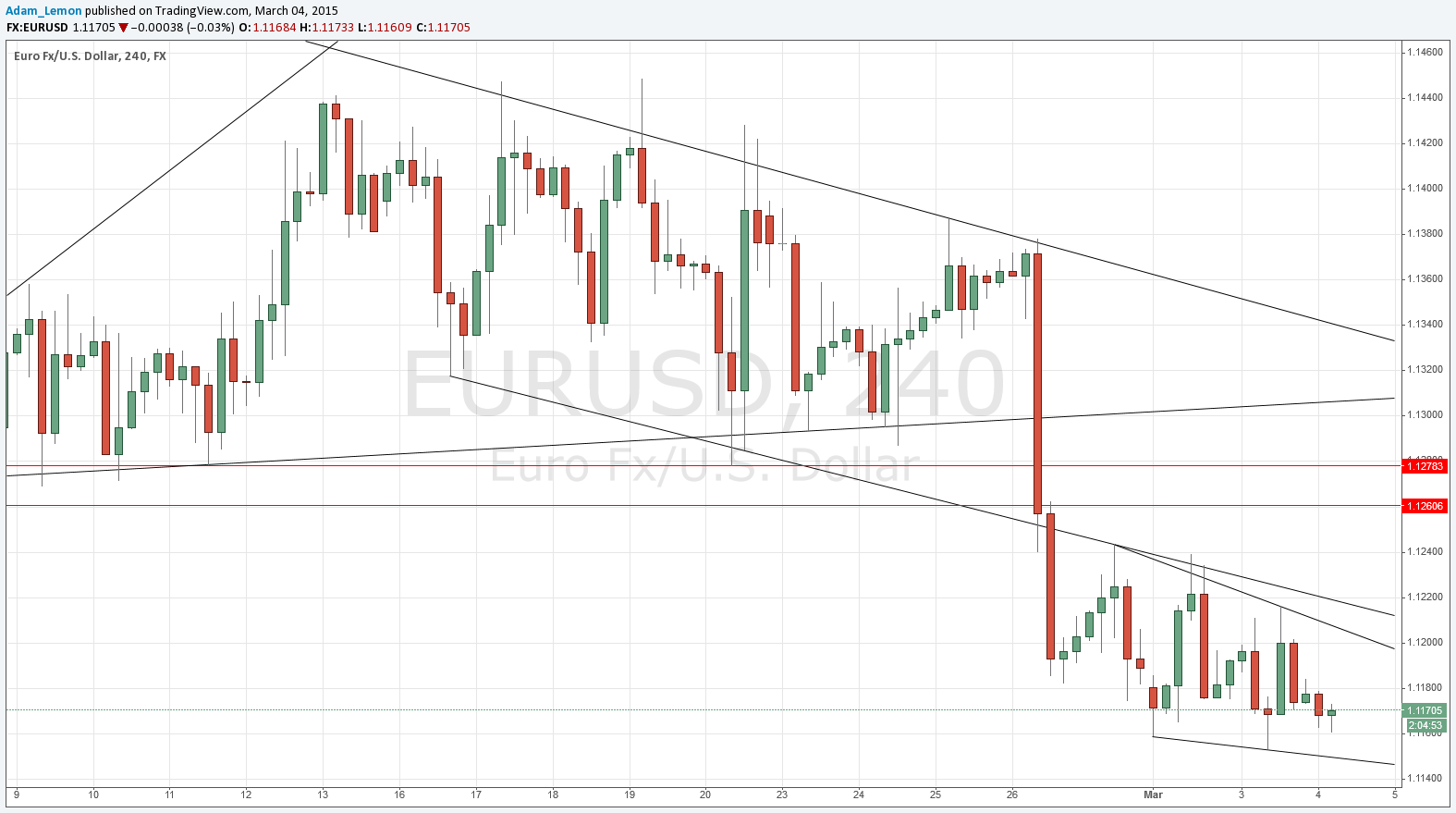

EUR/USD Analysis

Despite yesterday’s pull back up to 1.1215 or thereabouts after the New York open, the downwards trend is fully intact, as can be seen from the chart below. Note how the lower trend line of the broken channel above has been acting as mobile resistance, and we are in a new bearish channel that has actually been steepening. So although the price has not so far been willing to really break below 1.1150, this still looks likely to happen.

If the price does break above the trend lines, there is a zone from 1.1260 to 1.1278 that should be strongly resistant.

A sustained break back above 1.1300 would invalidate the downwards trend.

There are no high-impact events scheduled for the EUR today. Regarding the USD, the ADP Non-Farm Employment Change will be released at 1:15pm London time, followed later by ISM Non-Manufacturing PMI data at 3pm.