EUR/USD Signal Update

Last Thursday’s signal was not triggered and expired.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be made before 5pm London time only.

Short Trade 1

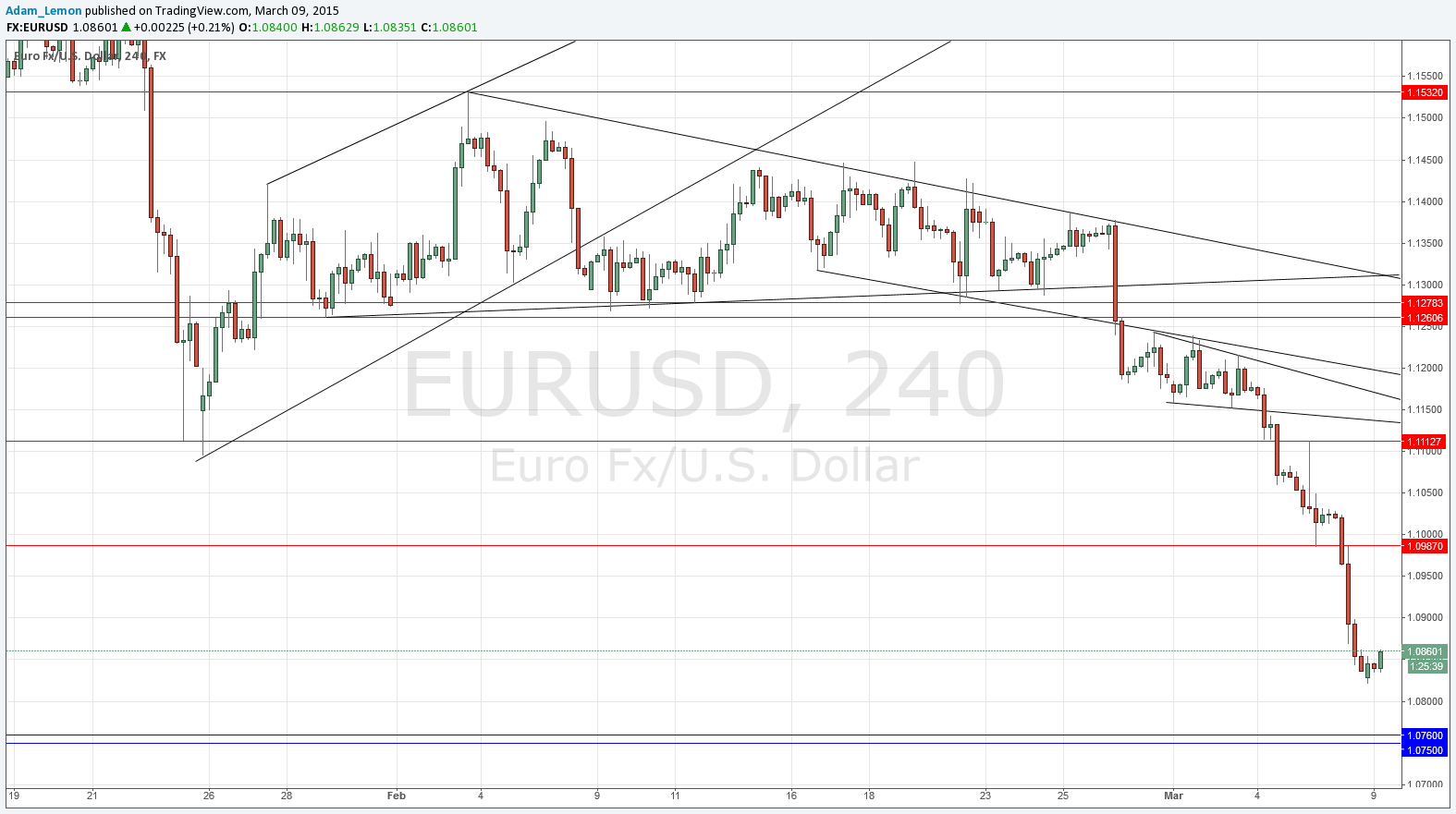

Go short following a bearish price action reversal on the H1 time frame immediately upon the first test of 1.0987.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Remove 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the first test of the zone from 1.0760 to 1.0750.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

EUR/USD Analysis

I forecast last Thursday morning that trading this pair short would continue to be the market’s “hot hand” for the remainder of the week and that is exactly what happened. The fall was quite dramatic, unusually so for this pair which tends to take its time when moving directionally. We have had a downwards move of about 300 pips over only two trading days. This suggests that the price is probably oversold and due a pull back. The earliest obvious flipped level at which to look for a short entry following a pull-back is slightly below the psychological whole number at 1.1000.

There is support below, admittedly from 13 years ago, but it is confluent with another psychological number at 1.0750. This could be a good level at which to seek a long trade that might be the start of a meaningful retracement.

Overall I remain very bearish on this pair. My colleague Christopher Lewis sees it falling all the way to parity.

There is a Eurogroup meeting today, which might have a big impact on the EUR.