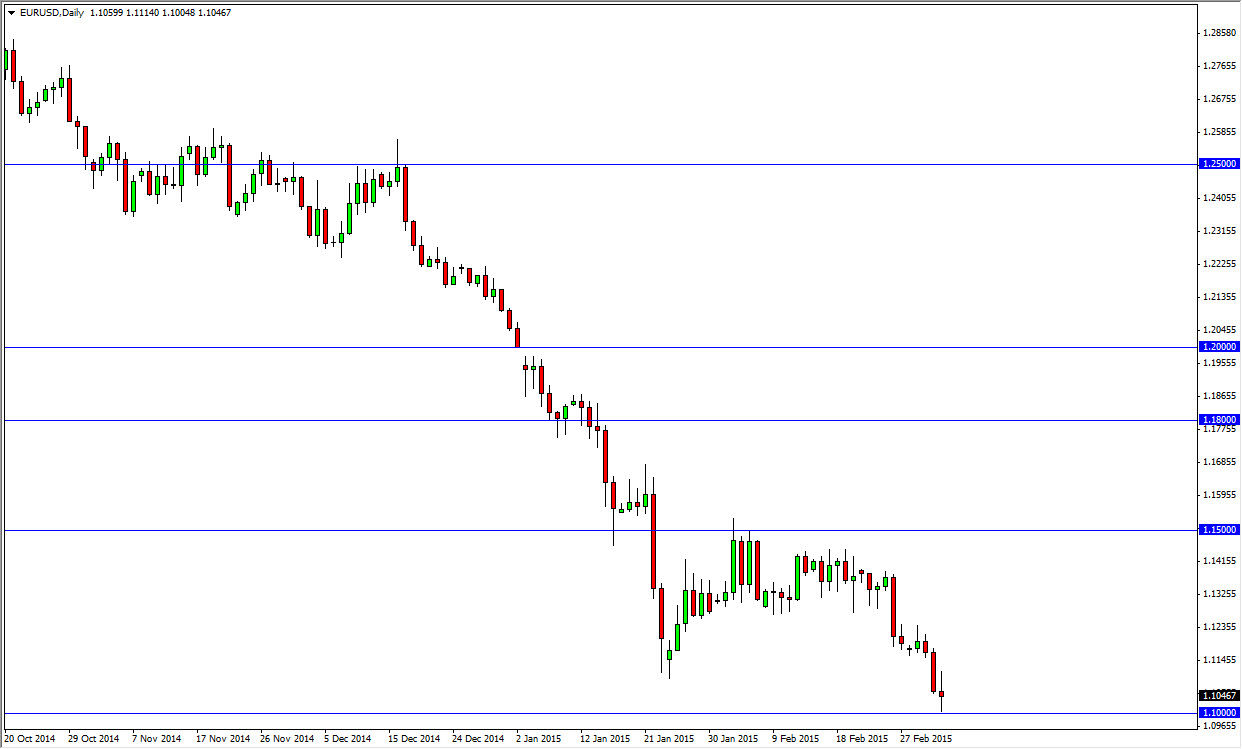

The EUR/USD pair tried to rally during the session on Thursday, but turned back around to test the 1.10 level, an area that I had looked at as a longer-term target. Now that we have hit that area, I find it very interesting that we do so. On the day before the nonfarm payroll number. Because of this, I think that today is going to be very interesting session, and if we close down below the 1.10 level, it’s very likely that the market will then find its way down to the parity level.

I believe that rallies will continue to be looked at with suspicion, and I believe that selling rallies that show signs of weakness will be the way to go going forward as they represent value in the US dollar. The question then becomes whether or not we can break down below the 1.10 level. If we can get below there, things get very heavy for the Euro, and I will start to put on long term positions.

Continued downward pressure.

I believe that there will be continued downward pressure again and this market place, so therefore I’m not even looking for any type of buying opportunity, and even if Friday, and that being a very bullish opportunity in this pair, I will simply step to the side and wait for it to run out of momentum closer to the 1.1350 level, and most certainly at the 1.15 level.

I believe that when we finally do break down below the 1.10 level, I believe that every rally will be a selling opportunity, and as a result this is a market that you can come back to again and again. As far as buying the Euro is concerned, I don’t really have a scenario in which a willing to do it, as there are far too many fundamental reasons why the European Union will continue to have deflationary pressure, and the European Central Bank will continue to have a very loose policy.