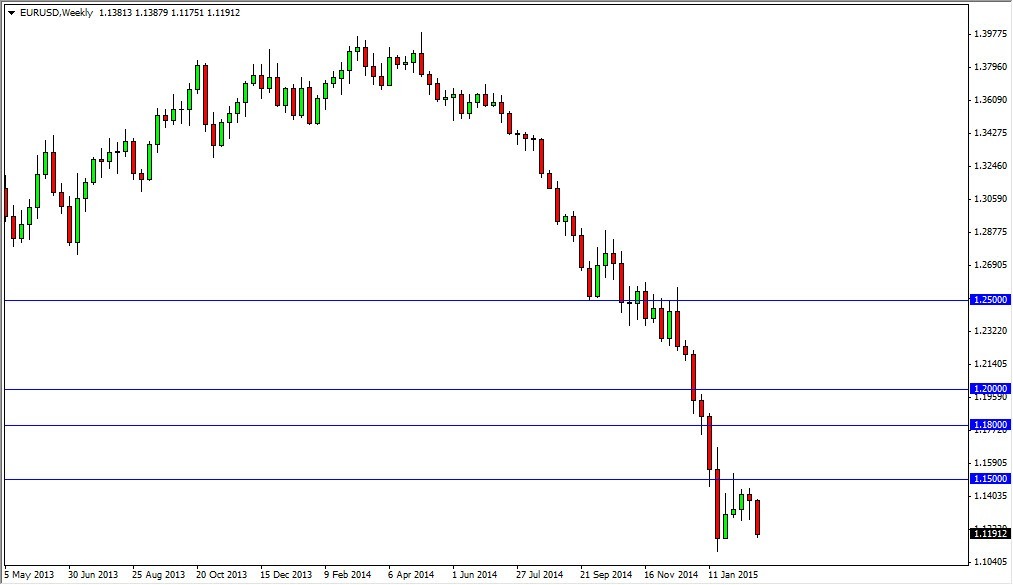

The EUR/USD pair fell during the course of February, and looks set to break down even farther as we entered the month of March. I believe that the 1.11 level of course is massively important as it was the recent low, but even more important is going to be the 1.10 handle. That being broken to the downside is very negative, and at that point time I believe that the EUR/USD pair will then head to the parity level. This is something that I never thought I would say to be honest. However, it looks like something that could very easily happen, as the European Union continues to struggle overall with deflation.

For the month of March, even if we get a bit of a bounce I am not interested in buying this pair. I believe that the Euro will continue to struggle and that 1.15 will continue to be massively resistive. With that, I think that rallies will continue to offer selling opportunity as it as they represent value in the US dollar. The European Central Bank of course should continue to offer liquidity, and that will work against the value the euro itself. Bond markets will continue to show very little in the way of returns, so the Euro will not be very attractive the most traders. With that, we should continue see the downtrend continue overall, and I believe that selling will continue to be the best way to trade this market.

I believe that the 1.10 level will be targeted during the month of March, but whether or not we can break down below there might be a completely different question. I think we will eventually, but at this point in time I would be pretty quick to take profits near that level. If we close down below there for the daily candle, at that point time I would be willing to sell and hang onto a longer-term position to the downside as I believe there isn’t much to stand in the way of parity at that point.