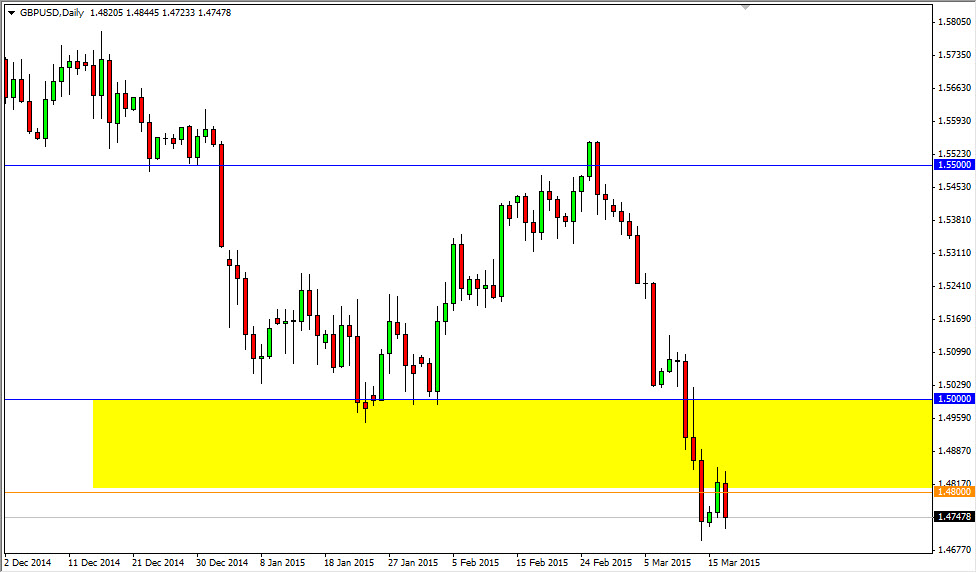

The GBP/USD pair broke down during the session on Tuesday, as the market continues the downtrend. We look at the chart attached, you can see that there is a yellow rectangle above the 1.48 level that extends all the way to the 1.50 handle. I look at this market as having quite a bit of previous support in that area, as we had bounced there several times over the last several years, which could be seen clearly on the monthly charts. Because of this, breaking down below there is a significant moment in this pair, and I believe that the downward pressure will continue to go going forward.

Because of this, the market should see a significant amount of resistance in this yellow rectangle, and that is a perfect place to see this market drop from, which of course is exactly what we have done during the session on Tuesday. If we can break down to a fresh, new low, I don’t see any reason why we don’t continue going down to the 1.45 level, and then possibly even lower than that.

Continuing to sell rallies

I continue to sell rallies in this pair, and every time the market bounces, I believe that the traders will come into the market and start selling as it represents value in the US dollar. Remember, the US dollar is by far the most favored currency in the Forex world right now, and as a result I have major reservations about shorting it. Because of this, it’s not until we get well above the 1.50 level that I would even consider buying this pair. In fact, I believe that the resistance probably goes all the way to the 1.52 handle as well.

Ultimately, I think we can go down to the 1.40 handle, but it is going to get a bit choppy between now and then, but ultimately the downward pressure should continue working this market lower, and offering quite a bit of trading opportunities in the process.