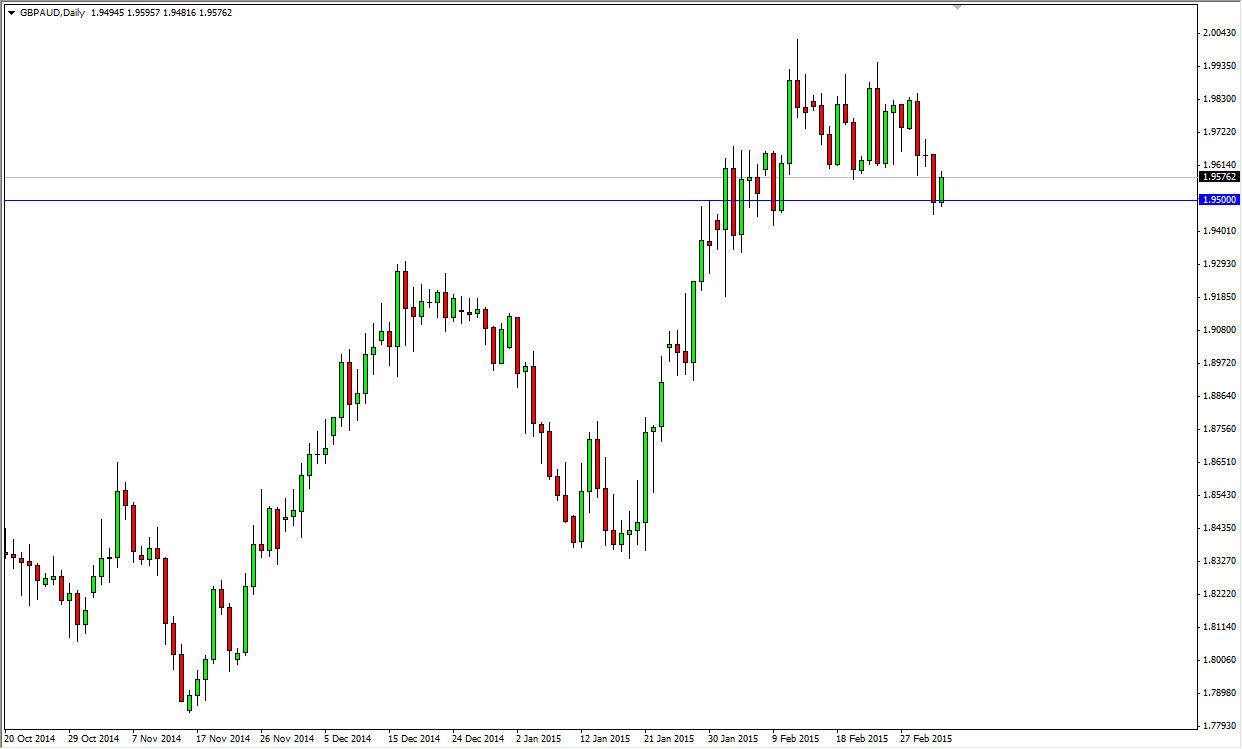

The GBP/AUD pair bounced slightly during the session on Thursday, showing the 1.95 level to be supportive. This was the anticipated move, and as a result I believe we are now going to try to break out and above the 1.96 handle. If we get that, we should return to the previous consolidation area, meaning that we could go to the 1.99 level after that. Ultimately, I think that the market is going to try to go to the 2.00 handle, as it is a large, round, psychologically significant number, and therefore more than likely going to be a bit of a magnet for price.

Because of this, I am looking for buying opportunities offer short-term charts. I think that a return to the 1.95 level would of course attract buying pressure, so at this point in time I really don’t have any interest in selling this pair, especially considering how soft the Australian dollar looks overall, while the British pound has been fairly stable.

Relative value

Remember, you are not necessarily making a strong that on the British pound, just suggesting that the British pound is going to be stronger than the Australian dollar. In a world where commodity markets are struggling massively, that’s not a real stretch of imagination. I believe that the Australian dollar continues to soften overall, and will probably selloff against most of the major currencies. The British pound of course will be any different, as although it’s not necessarily a strong as the US dollar, it’s at least a market that is fairly stable and strong.

We will have to wait to see what the fact that the jobs number out of the Americans have on the markets overall today, but quite frankly, this is a marketplace that should be somewhat insulated from the volatility, so on the move higher or a move down to find support, I’m willing to go ahead and start buying this market, even if it’s before the announcement comes out.