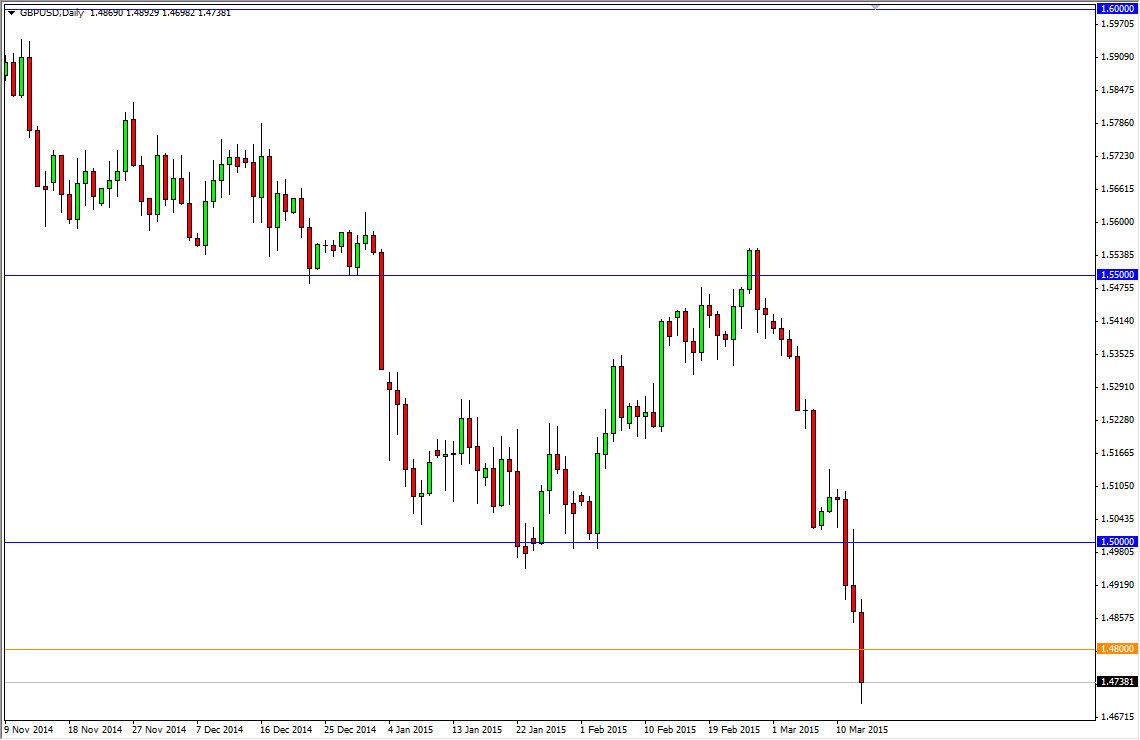

The GBP/USD pair broke down below the 1.48 level on Friday, which was the bottom of the support zone that I had been talking about recently. Because of this, it appears that we are ready to start freefalling in this pair as well, and that means of the US dollar continues to strengthen in general. In fact, it’s difficult to imagine a scenario in which the US dollar loses value for any significant amount of time, and I believe that the entire zone between the 1.48 level and the 1.50 level in some being the “ceiling” in this market.

It’s hard to tell exactly how far we go from here, but I believe that the 1.45 level is essentially a given. Ultimately, I believe that the large round numbers are the things that you want to pay attention to when it comes to targeting, because there’s really not a whole lot to work with at this point historically speaking. Most Forex brokers don’t give you enough history to start looking for support back in the 80s for example.

Selling rallies

The Forex markets are going to be incredibly simple in the near term. You only have to ask yourself one question, “Is the US dollar going to rise or fall at this point?” By doing so, you will be able to know whether or not you have to buying or sell the GBP/USD pair, as well as the US dollar against other currencies such as the Euro and the Swiss franc. Quite frankly, most of you probably don’t remember markets that were that simple, that they really are starting to get that way again. It’s essentially the US dollar versus the world, which for the longest time was the way the Forex markets worked.

That’s not to say this goes on forever, but I need to see a long-term buy signal in both the pound than the euro in order to start thinking about reversing any trends at this point. I know some of you out there are looking to find the absolute bottom of this move, but right now it is far too dangerous to try to do that.