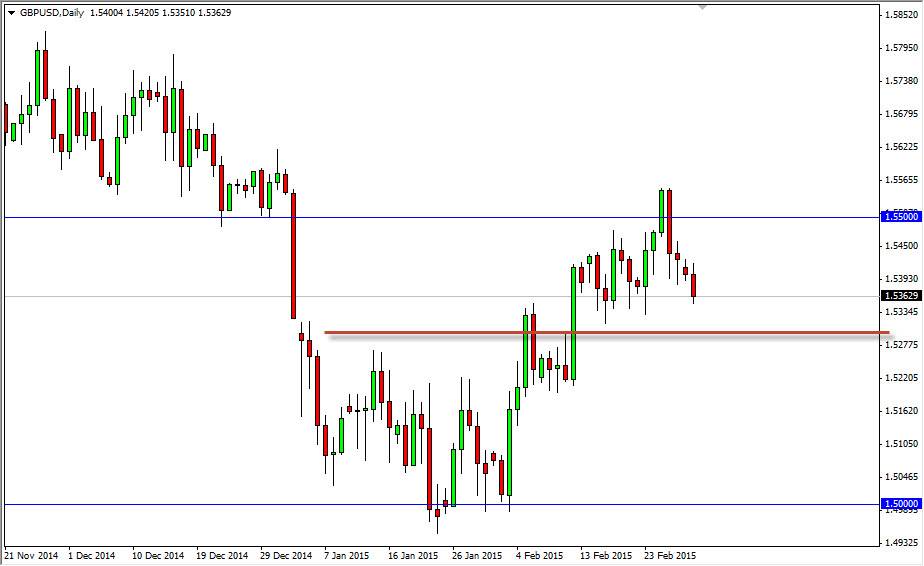

The GBP/USD pair fell during the course of the Monday session, as we approached the 1.53 level which has been minor support in my opinion. I believe that if we can get below there, then the markets first to drop towards the 1.50 level. With that, I would be bearish of this marketplace although I recognize that there could be a lot of noise between here and the 1.50 level. That level should be massively supportive, as it is a large, round, psychologically significant number. In fact, I do not anticipate this market breaking down below there anytime soon.

However, I believe that the 1.55 level above is massively resistive as well, and as a result I am not looking to buy this market, rather looking to sell it on signs of resistance near that level if we rally. I see massive amounts of resistance above that level, extending all the way to the 1.58 level.

Ultimately, there is no way to buy this market.

Ultimately, I believe there is no way to buy this pair, simply because there is far too much in the way of downward pressure. In fact, I have absolutely no scenario in which a willing to buy this pair unless of course we form a longer-term buy signal. This would be something along the lines of a weekly hammer, or better yet - a monthly hammer.

I believe that this market will continue to be one that is probably traded off of the short-term charts, as there are quite a few clusters between the 1.50 level, and the 1.55 level. Because of this, the markets look as if it will essentially offer short-term selling opportunities again and again, and it is going to be difficult to hang onto the trade for any real length of time because of the potential volatility that we will see. Ultimately, I don’t want to hang onto this trade for any real length of time as the volatility continues to be an issue.