By; DailyForex.com

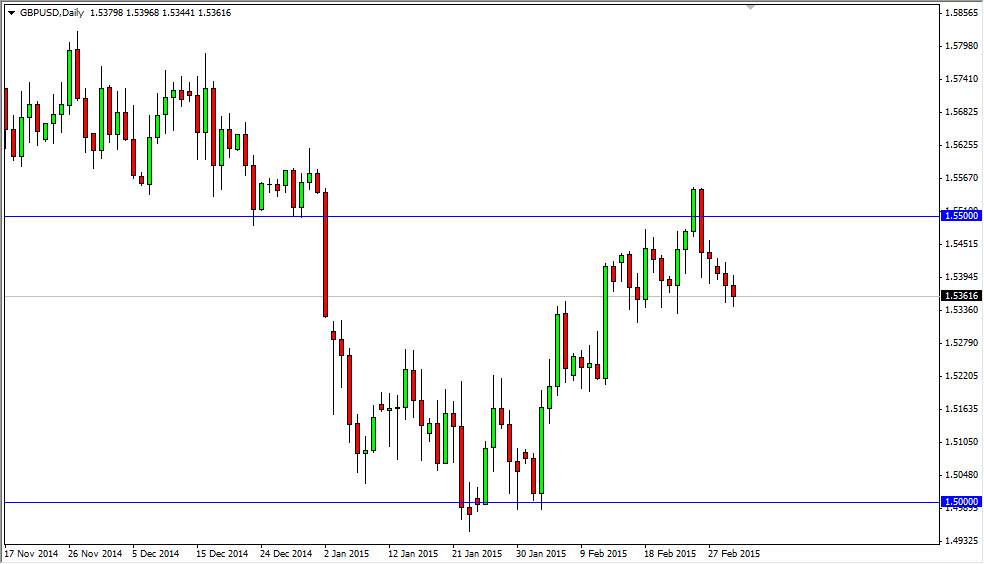

The GBP/USD pair fell during the course of the session on Tuesday, testing the 1.5350 region. This is an area that has been supportive, and I believe extends all the way down to the 1.53 level. With that, I believe that the buyers are going to step back into this marketplace, and perhaps push the GBP/USD pair to the 1.55 handle, which of course is resistive. Ultimately, I do not expect this market to break out above there though, because I feel that there is a significant amount of resistance all the way to the 1.58 handle. With that, the market should find plenty of sellers up there so when we break above the top of the range for the session on Tuesday, I believe that it is a short-term buying opportunity, followed by a longer-term selling opportunity.

Patience will be needed

Patience will be needed in this market, as the better opportunity is to sell this downtrend. A short-term buying opportunity is just simply going to be a nice opportunity to pick up a few pips. However, the real money will be in shorting this marketplace up in the resistance region.

On the other hand, if we break down below the 1.53 level, I think we will grind it out down to the 1.50 level, where I see a massive amount of support. In fact, I believe that it is a long-term support barrier that will continue to flex its muscles every time we reach down there. Ultimately, if we were to break down below there, this market would in fact break down significantly, as it would be another leg down as far as I can see.

On the other hand, we did break above the 1.58 level, this market would in fact have changed trends at that point in time. It would be a longer-term buy-and-hold type of situation, giving us an opportunity to buy every time the market dips. However, is going to take an extraordinarily strong change of momentum in order to do that. I remain bearish but also recognize that volatility is ahead.