GBP/USD Signals Update

Yesterday’s signals were invalidated as the price did not reach either of the key levels during yesterday’s London session.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be made between 8am and 5pm London time only.

Long Trade 1

Go long if at 9am London time there is a bullish candle closing on the H1 chart in the top quarter of its range, making a high for the day, and if it breaks its high during the next hour by 1 pip before it breaks its low.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 25 pips in profit or when the price hits 1.4990, whichever happens first.

Take off 50% of the position as profit when the trade is 25 pips in profit or when the price hits 1.4990, whichever happens first, and leave the remainder of the position to ride.

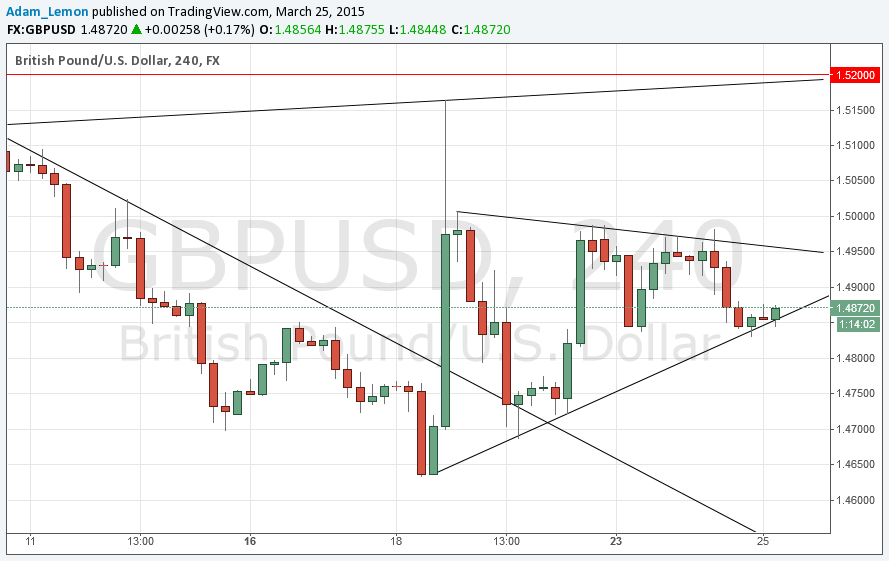

GBP/USD Analysis

Yesterday again was a relatively quiet day for this pair in view of the strong moves on some of the other USD pairs, which suggests the best action is lying elsewhere right now.

The technical picture is still showing a triangle with a flat top, suggesting a bullish break out of the local resistance at around 1.5000. Interestingly, the short-term bullish trend line that I highlighted yesterday has been tested early this morning and seems to be holding. If the first hour of the London session is very bullish, the price should be likely to continue towards the top of the triangle today.

A breakout above the upper trend line would be bullish, but I do not seek a short there off any bearish reversal today.

A break below the bullish trend line early in the London session would on the other hand be a very bearish sign.

There are no high-impact events scheduled today concerning the GBP. Regarding the USD, at 12:30pm London time here will be a release of U.S. Core Durable Goods Orders data.