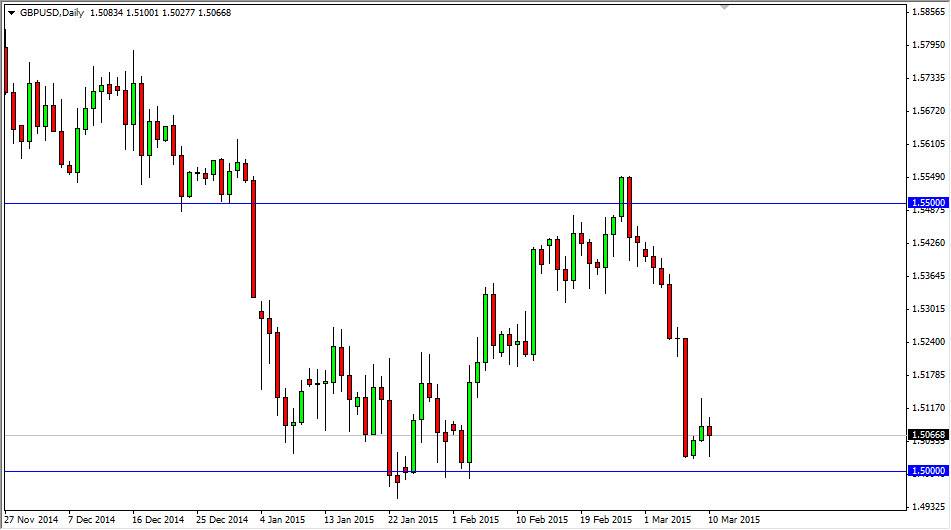

The GBP/USD pair broke down during the session on Tuesday, and tested the 1.50 level. Towards the end of the session in order to determine that there was in fact support there yet again. It’s a large, round, psychologically significant number, so I don’t see why we would be a break down below that level with ease anyway. On top of that, the area has offered support in the past recently, and as a result it appears that the market should continue to go much lower, although after a significant amount of momentum building.

Now that we have formed a hammer during the session on Tuesday, and off of the 1.50 level, it makes it much more obvious to me that a break down below the 1.50 level is massively bearish. With that, the market should continue much lower, probably down to the 1.48 level in the short-term as it is the bottom of that supportive region.

US dollar remains King.

At this point time, really doesn’t matter what you think, its US dollar that matters. The British pound itself isn’t necessarily the worst currency in the world, but everything is doing poorly against the US dollar, and I do not anticipate that changing anytime soon. Because of this, I am a seller on rallies that show signs of resistance, as the US dollar should continue to strengthen overall. In fact, the US Dollar Index has broken the 98 level to the upside, and is getting ready to attack the 100 level, an area that I never thought I would see. Every time I think the US dollars amount to pull back and give up this massive uptrend, and continues higher. With that, I absolutely refuse to go against what I think is the strongest currency in the world. In fact, I see the 1.55 level above as resistive, and I also think that area extends all the way to the 1.58 level! With this, this is a “sell only” market as many other markets. With the USD on the back half of the equation are now.