Gold prices ended Wednesday's session up 1.6% as the dollar tumbled after the Federal Reserve downgraded its view of economic activity and indicated that interest rates may rise at a slower pace than anticipated. Gold prices reached $1175.62 an ounce yesterday, the highest level in eight session, before pulling back to $1166 area. While The Federal Reserve removed a reference to being "patient" in tightening, Chair Janet Yellen said "Just because we removed the word patient from the statement doesn’t mean we are going to be impatient...This change does not mean an increase will necessarily occur in June, although we cannot rule that out".

Although The Federal Reserve moved a step closer to hiking rates, it seemed less optimistic about the economic growth outlook. In its summary of economic projections, the U.S. central bank cut its inflation outlook and reduced growth estimates, prompting the market to push back the expected timing of lift-off. From a technical perspective, I think yesterday's price action which brought the market above the 1166 level is positive.

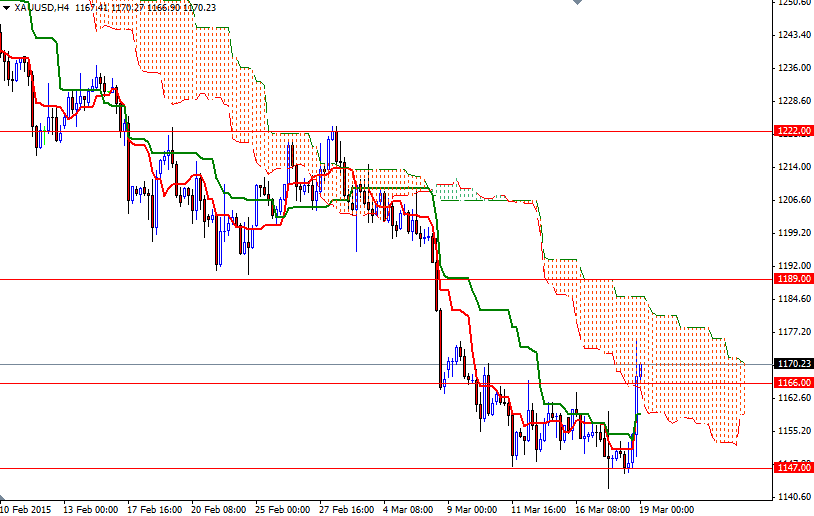

However, as you can see on the 4-hour chart, the XAU/USD pair is now trading within the borders of the Ichimoku cloud. Bullish Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-day moving average, green line) crosses on shorter term charts suggest that a test of 1185.30 - 1189.63 is possible if the 1176 resistance level is cleared. The bulls will have to shatter this critical resistance so that they can challenge the bears on the next (1200 - 1205) battlefield. To the downside, support can be found at 1166 and 1159. If XAU/USD breaks below 1159 level, we will probably head back to the 1147 support level.