Gold prices ended Monday's session down 0.58%, or $7.04, to settle at $1206.41 an ounce as the U.S. dollar continued to strengthen and buoyant global equities dented demand for the precious metal. The XAU/USD pair initially went higher after a weekend interest rate cut in China but failed to breach the resistance around $1222 as investors poured money into stocks. The Nasdaq Composite broke 5000 for the first time in 15 years while the Dow Jones and S&P 500 indexes hit records.

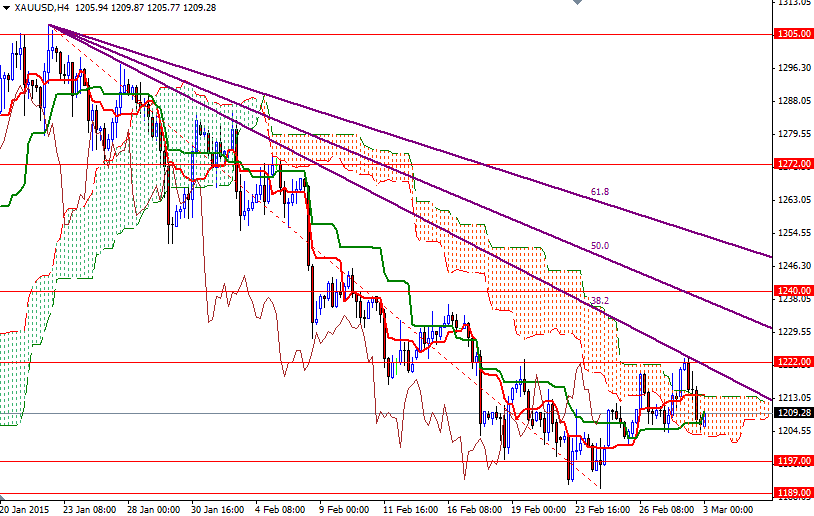

This week sees a deluge of U.S. economic data but the big event will be on Friday, when the Labor Department releases its employment report for February. In the mean time, I will focus on the charts as usual. On the 4-hour chart, the market is moving within the borders of the Ichimoku cloud and the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-day moving average, green line) are positively aligned. However, the Chikou-span (closing price plotted 26 periods behind, brown line) line is moving below the cloud.

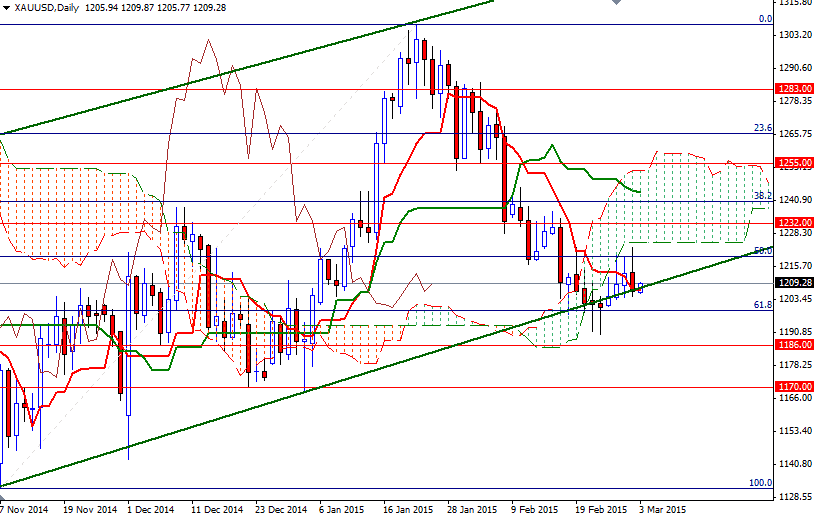

That means XAU/USD will need to clear 1222 - 1225 area in order to gain enough traction and challenge the critical resistance at 1240. Initial resistance is located at 1215/3. On the daily time frame, we have a bearish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) cross and the Ichimoku cloud on top of us is weighing on the market. The first key support to the downside is currently at 1197. If the market closes below this, it is likely that we will test the 1189/6 area.