Gold prices fell for a fourth straight session on Thursday as gains in the dollar and equities diminishes the appeal of safe haven assets. While some investors moved to the sidelines ahead of key U.S. employment data, some pulled back from bets on the metal. The Labor Department's employment report is closely watched by the Federal Reserve, and could influence the timing of the central bank’s move to hike interest rates.

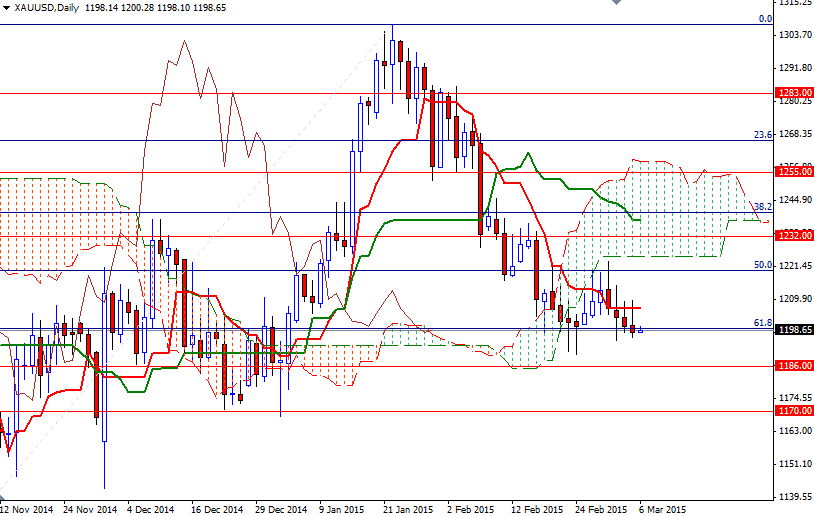

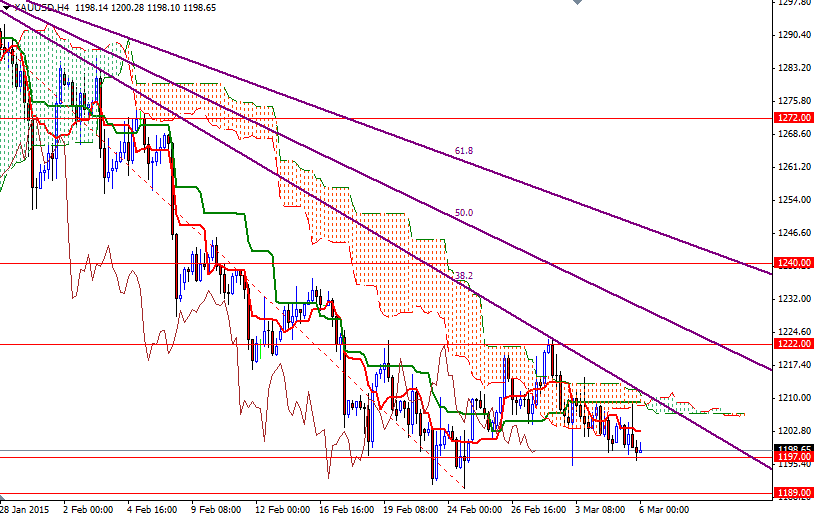

Looking at the charts from a purely technical point of view, I think gold will struggle to move higher as long as the market trades below the Ichimoku clouds on both the daily and 4-hour charts. Basically, the overall trend is up when prices are above the cloud, down when prices are below the cloud and flat when they are in the cloud itself. In other words, the path of least resistance for gold appears lower. It is quite possible that the pair will maintain its bearish bias if the 1189/6 support gives way. Below that, a significant support is located at the 1170 level.

However, if prices manages to hold above the 1197/5 zone and starts to rise, it wouldn't be surprising to see the XAU/USD pair approaching the cloud (4-hour chart). Beyond this area between the 1209 and 1211 levels, the first real challenge will be waiting the bulls at 1225/2.

Only a close above 1225 could give the bulls the power they need to push prices higher and revisit the 1232 and 1240 levels.