Gold snapped a four-week losing streak last week, helped by a softer dollar and hopes that the Fed will not rush to begin normalizing the stance of monetary policy, but shed about 5.4% in February. The argument for hiking interest rates sooner was bolstered by the government's latest jobs report, which showed the economy added more than a million jobs over the past three months, but last week Federal Reserve Chair Janet Yellen repeated that inflation was too low and the committee wanted to be reasonably confident that it would move back up toward 2% over time.

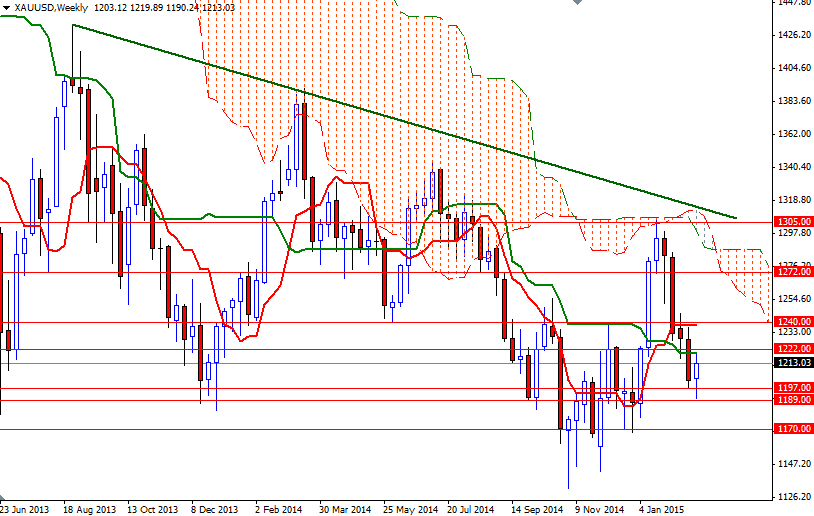

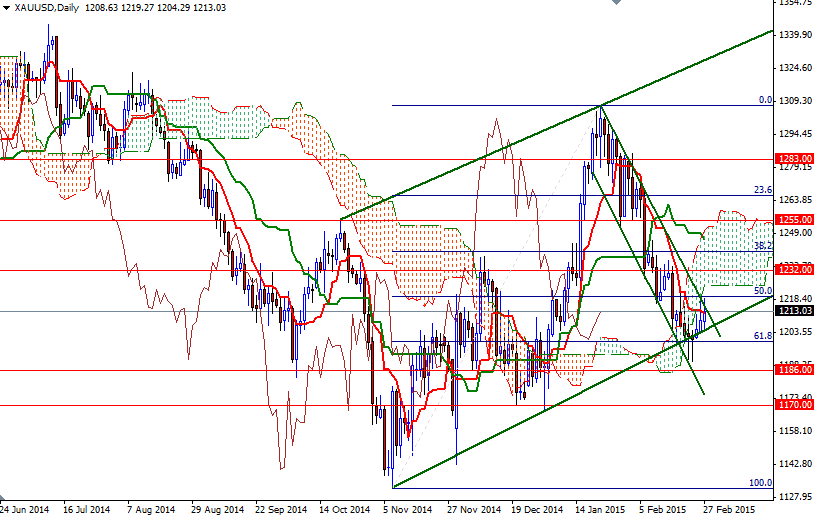

Yellen has been trying to keep the markets away from speculation on rate hikes though several committee members have hinted that an increase in interest rates is on the cards this year, perhaps as soon as June. Positive U.S. economic data and persistent rally in U.S. and Japanese equities will likely depress the attractiveness of safe-haven gold. However, over the short-medium term, the market may continue to witness a range-bound movement. As you can see on the charts, gold has been treading water for weeks.

From a technical perspective, there are two things to pay close attention at the moment: the short term descending channel which is dating back to January high of 1307.47 and the medium term ascending channel that originates in October. Technically speaking, the Ichimoku cloud indicates an area of resistance (or support depending on its location) and thickness of the cloud is important as well because the thicker the cloud, the less likely it is that prices will manage a sustained break through it. In other words, the daily chart indicates that there will be tough resistances ahead. The key levels to watch will be 1286 and 1240 going forward. If the bulls want to take over and stay inside the ascending channel, they have push prices back above the 1240 level. In that case, they will have another chance to reach the 1255/8 area. I think passing through that barrier is essential for a continuation towards 1266/72. If the market fails to overcome the daily could and drops below the 1189/6 support, then the bears will be targeting 1170 next. Capturing this strategic point would suggest that we are heading back to the 1157 level.