Gold prices rose $3.79 an ounce yesterday, up for the fifth straight session to $1192.90, as diminishing likelihood of an early rate increase continued to lure investors to the precious metal. The XAU/USD pair traded as high as $1194.90 but gave up some of its earlier gains after better than estimated U.S. data triggered profit taking. The Commerce Department's data showed sales of news homes climbed 7.8% to a 539000 annualized pace and the Labor Department said the consumer price index rose 0.2%. Markit reported that its flash manufacturing purchasing managers’ index picked up to 55.3 in March, from 55.1 in February.

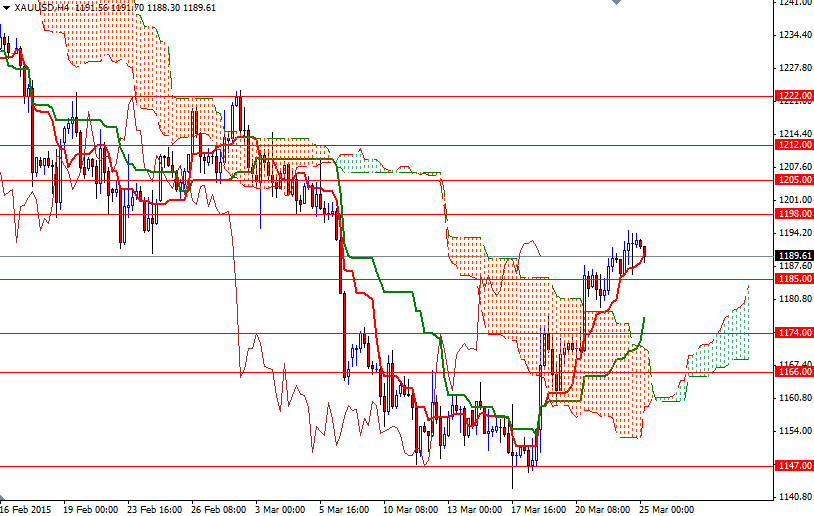

The recent string of positive days brought some optimism and a constructive short term technical picture. The market is trading beyond the Ichimoku clouds on the 4-hour charts and the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-day moving average, green line) are positively aligned. In addition to that, the Chikou-span (closing price plotted 26 periods behind, brown line) climbed above the cloud. Because of that, I think the market will have a tendency to approach the daily cloud, unless prices sink below the 1166 support.

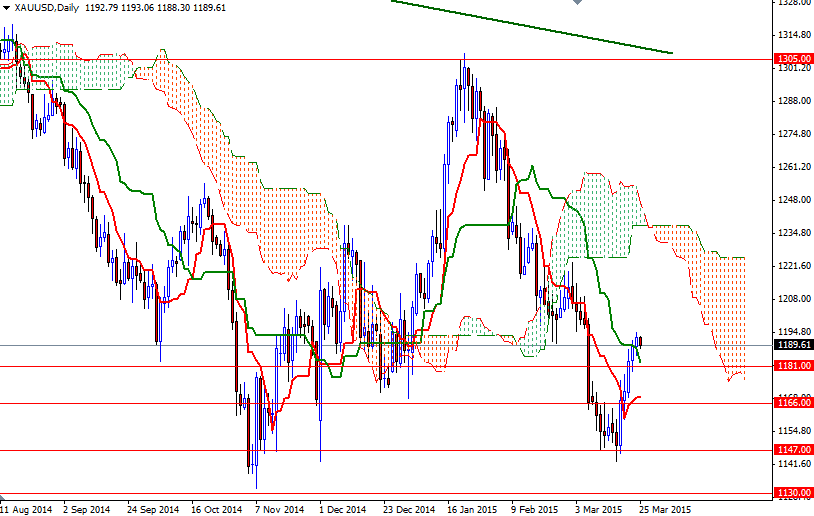

However, the long term trend is rather bearish in the big picture (XAU/USD is still feeling the pressure from the weekly cloud) and that will probably prevent gold from significantly rallying in 2015. On its way up, there will be hurdles such as 1198, 1205 and 1212. The XAU/USD pair has to break above 1212 in order to test the 1225/2 area. If the dollar gains some strength and prices start to fall, expect to see support at 1185 and 1181. A break below 1181 could provide the bears extra power they need to visit 1177/4.