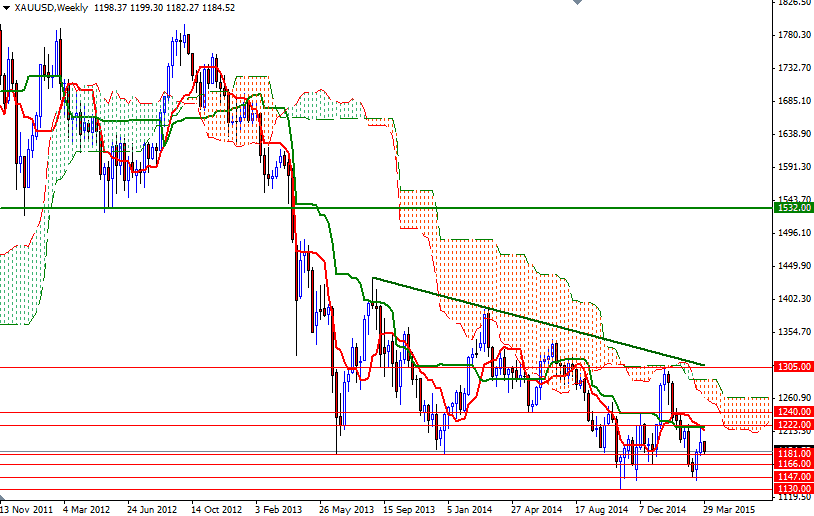

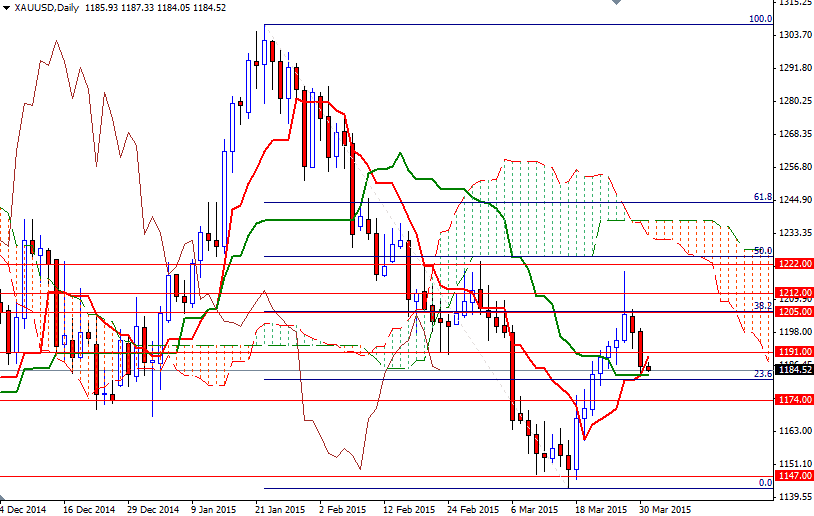

Gold has been under pressure since the market peaked around the $1305 level in January. The steep rise in the dollar pushed prices back below the support at $1186 at the beginning of March and consequently we returned to the levels last seen in November. Gold prices have rebounded nearly 3.5% since the market bounced off the $1142 level and currently hovering just above the $1181 support. Gold's gains were helped by the Federal Reserve's latest policy announcement which pushed market bets on the timing of the first rate increase from mid-year to the fall.

Although the possibility that the U.S. central bank will wait beyond June to begin tightening monetary policy is a good news for gold, the improving economy and low inflation help stocks advance and give investors few reasons to hold safe-haven investments such as gold. It appears that the dollar and U.S. equity rallies still have more room to run and therefore the precious metal will find it difficult to withstand these headwinds in the future. Fed Chair Yellen emphasized that a lift-off in rates would be highly dependent on how the economy actually performed in coming months while noting the inflation undershoot was no longer receiving special emphasis.

However, the weekly chart shows that buying interest continues to emerge on dips. Until the market either shatters the support in the 1130 - 1147 zone or climb above the 1307 level, "buy into weakness, sell into strength" will probably be the way to go. Breaking below 1130 would put us back on track with such a scenario eying subsequent targets at 1114, 1088/6 and 1062.85. In order to gain more traction and start a journey towards the weekly cloud which occupies the area between 1257 and 1285, the bulls have to pass through the 1240/22 region. Once beyond that, they will have another chance to tackle the 1307/5 resistance.