Gold prices settled lower on Wednesday as a stronger dollar offset gains from safe-haven bids prompted by a slide in U.S. equities. The XAU/USD pair traded as low as $1197.18 an ounce after the Institute for Supply Management said its non-manufacturing index climbed to 56.9 from 56.7 in January. The ADP Research Institute said businesses added 212K employees in February after an upwardly revised 250K gain in the prior month - January's gain was originally reported at 213K

We are waiting for monthly U.S. employment figures due to be released on Friday for more clues about the economy. In the meantime, the spotlight will be on the European Central Bank. The XAU/USD pair remains within the trading range of the past 11 days during the Asian session and today may not be any different. Eventually, the market will break out of this rectangular range.

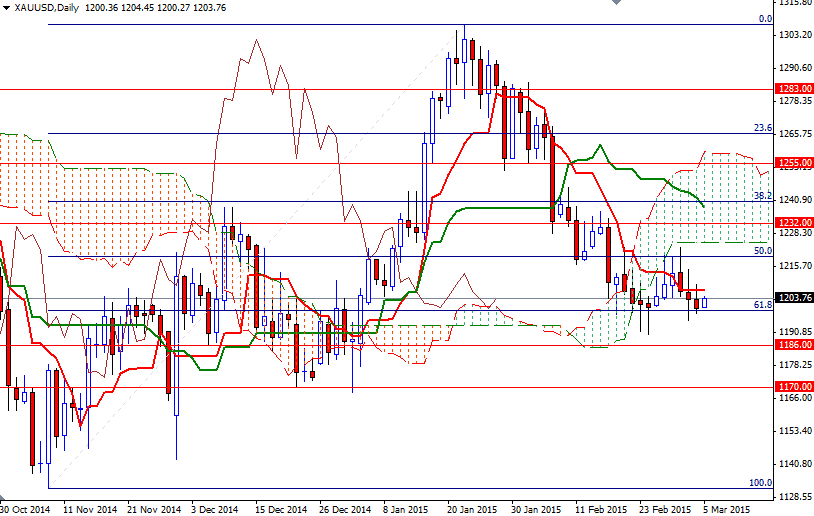

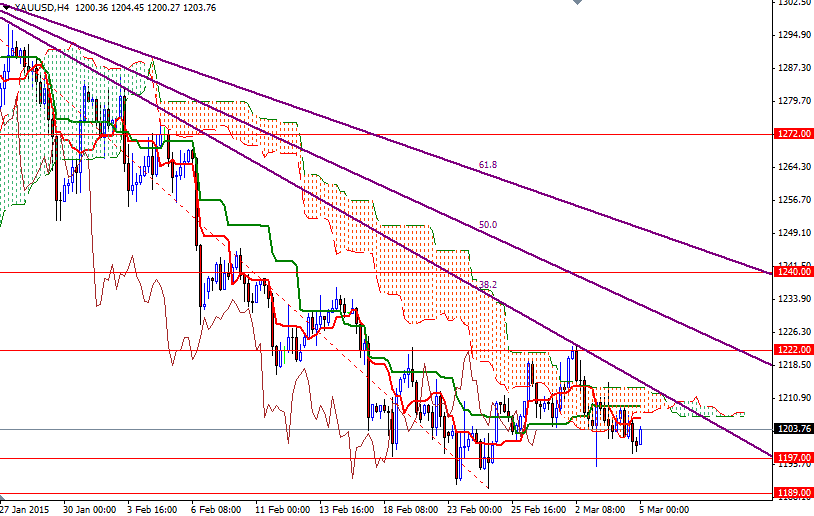

To the upside, initial resistance rests at the 1215 level. If prices climb and stay above 1215, then the market will probably have enough momentum to revisit the bottom of the daily cloud. Technically, trading below the Ichimoku clouds (on both the daily and 4-hour charts) gives sellers an advantage. That means the XAU/USD pair has to break through the 1225/2 resistance zone in order to test the 1232 and 1240 levels. On the other hand, if the market falls through the 1197/5 support, the next stop will probably be the 1189/6 area. A daily close below 1186 would make me think that the bears are strong enough to retest the 1170 level.