Gold prices settled higher yesterday, extending gains from the previous session, on increasing views the pace of rate hikes is likely to be slower than previously expected. The U.S. central bank not only downgraded its economic growth and inflation projections at its latest meeting but also lowered its interest rate trajectory. Fed officials expect the federal funds rate to reach 0.625% at the end the year, down from 1.125% forecast in December.

On Wednesday, the Federal Open Market Committee said that "An increase in the target range for the federal funds rate remains unlikely at the April meeting". The committee also said it will be appropriate to tighten “when it has seen further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term". While a short term upswing is quite possible in the coming weeks, but I think the precious metal will come under pressure again sometime later.

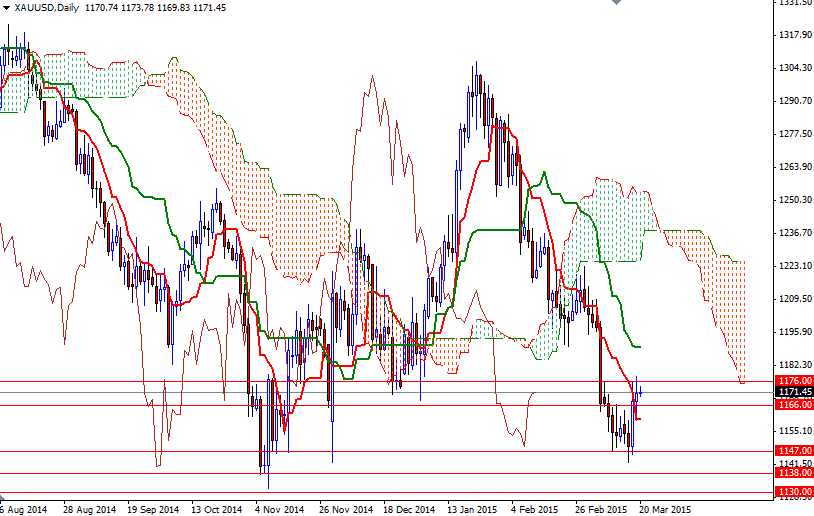

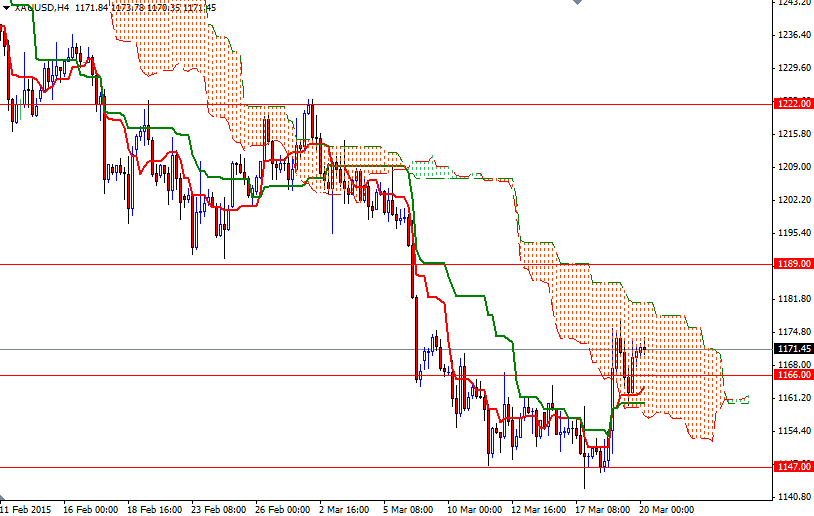

On the weekly and daily time frames, prices remain below the Ichimoku cloud, suggesting that the overall trend is bearish. However, on the 4-hour chart, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-day moving average, green line) are positively aligned. Until this mixed technical picture changes, we may spend some more time within the cloud (4-hour chart). The XAU/USD pair has to push its way through the 1176 - 1178.40 resistance zone in order to gain more momentum. In that case, I think the bulls will be aiming for 1189. Currently initial support is at 1166, followed by the bottom of the cloud at 1158. If gold prices falls through 1158, we will probably see the market testing the 1247 level.