Gold prices fell on Tuesday as investors opt to stay on the sidelines ahead of the Fed's policy statement. Fed officials previously said that a stronger labor market would pave the way for tightening monetary policy even if inflation stays low. Markets are now looking to the Fed to clarify the outlook on interest rates. The U.S. central bank will also provide new economic projections, and Chair Janet Yellen is scheduled to give a post-meeting press conference.

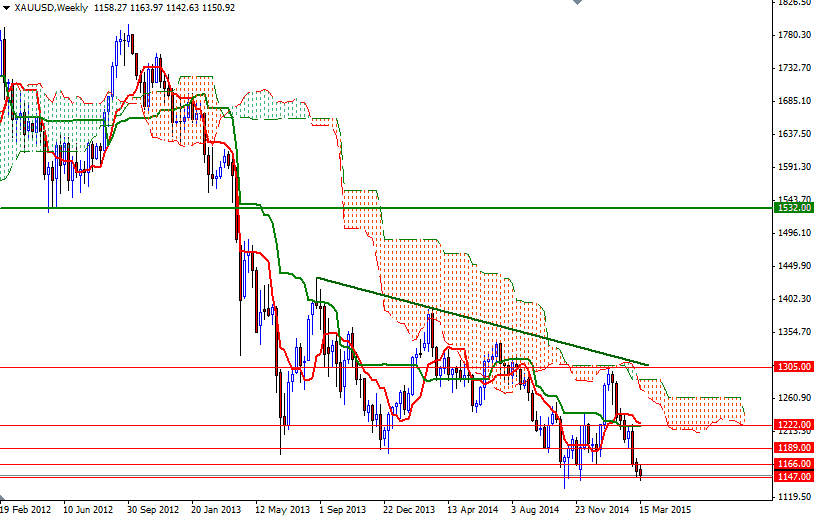

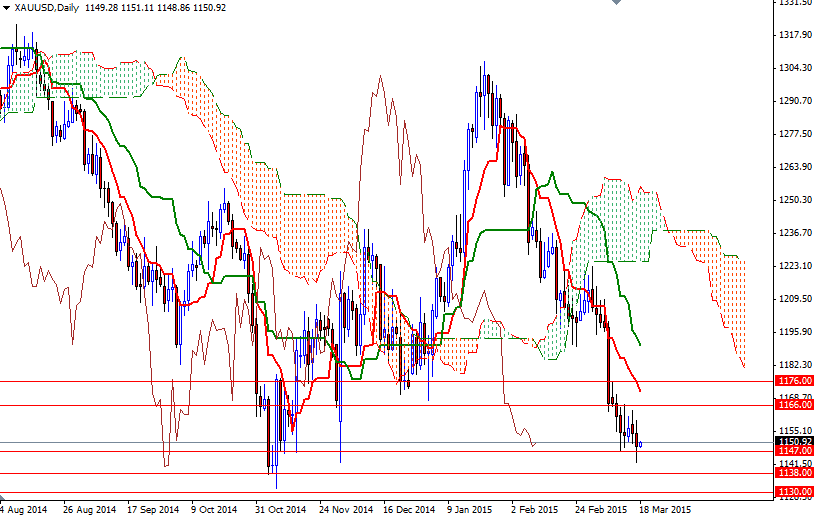

Market players have been speculating that the Federal Reserve is going to remove the word "patient" from its policy statement but I don't think such modification would lock them into an immediate rate rise. However, as I often say, its not the news, but the market reaction to news that matters. The XAU/USD pair is currently hovering above the 1147 support level while the market continues to feel pressure from the Ichimoku clouds on the 4-hour time frame. Until the announcement, I think that this tight range will contain the market.

To the upside, there are hurdles on the way such as 1166 and 1176. If the market breaks through, it looks like prices will retrace towards 1189 and possibly even 1200. On the other hand, it is quite possible that the pair will continue its bearish tendencies if prices drop below the 1138 level. If the bears increase the downward pressure and this support is broken, then we are likely to test 1130 afterwards. Closing below the 1130 support on a daily basis would indicate that the XAU/USD pair is heading towards the 1092/85 zone.