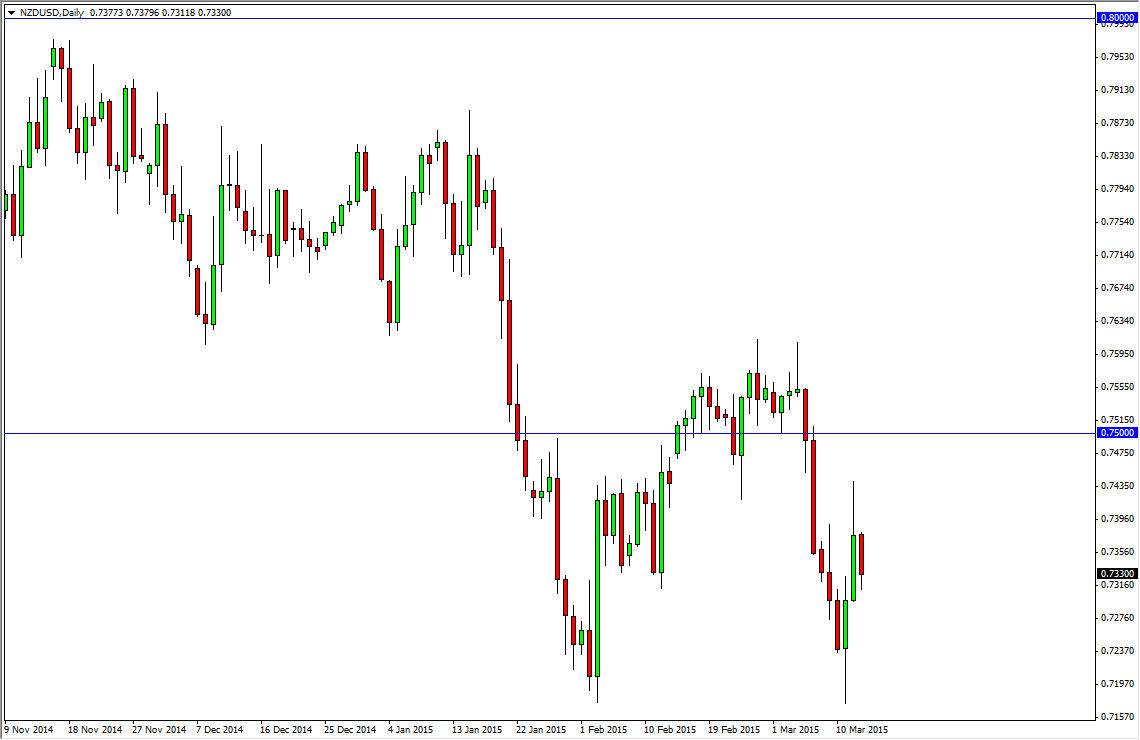

The NZD/USD pair fell during the session on Friday, as the US dollar strengthened against many of its counterparts. This is a pair that has been negative for some time, and quite frankly if people are concerned about owning such currencies as the British pound or the Euro, I find it very difficult to imagine that the New Zealand dollar is going to do well in that type of environment. Remember, the Kiwi dollar is essentially a “risky” currency, not in the sense that New Zealand is a dangerous place to invest, rather that the New Zealand economy is highly dependent on exports, which of course means Asia and the developing world. The developing world is not doing well at the moment, so therefore New Zealand doesn’t get as much in the way of exports over the longer term. This of course drives down the value for the Kiwi dollar, as well as demand.

Ultimately, I believe we break down from here

The New Zealand central bankers recently stated that they believe that the 0.68 is fair value for this pair, and quite frankly I don’t see any reason why they don’t get their wish. The 0.75 level above is resistive, we could test that area but I think it simply would offer another selling opportunity. Quite frankly, the resistance goes all the way to the 0.7650 level, and with that the market should continue to see trouble every time it rallies. You have to think about this as offering value in the US dollar, and then that of course makes the NZD/USD pair the same as the EUR/USD pair, and the GBP/USD pair, as it is simply a matter of looking for opportunities to own the US dollar cheaply.

That being said, the truth is that the New Zealand dollar is a lot riskier than the British pound or the Euro, so this pair will recover much later than those two. I think this is one that you can continue to short for the foreseeable future.