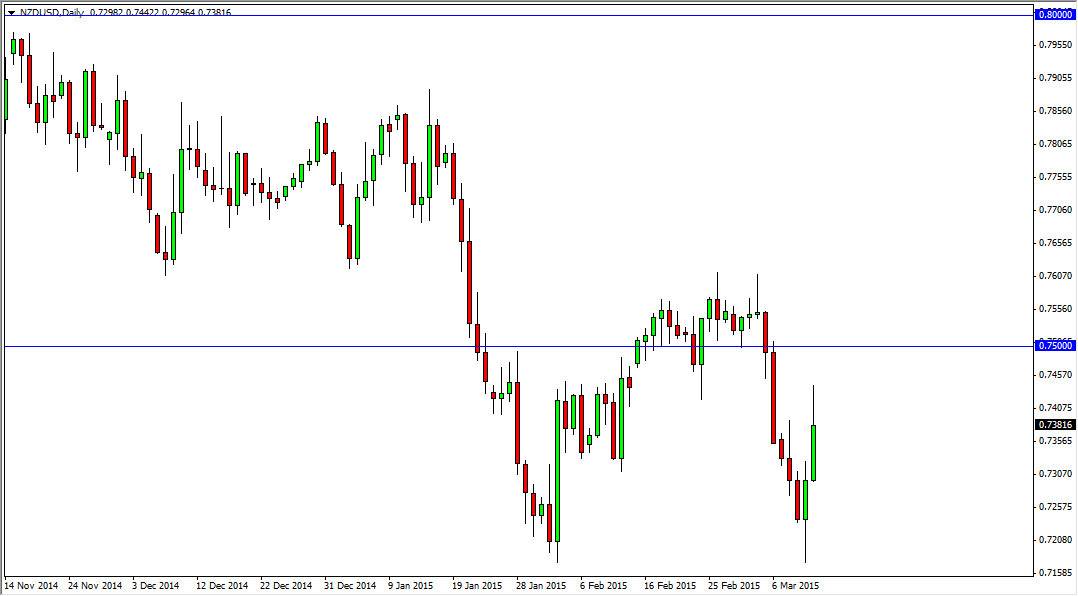

The NZD/USD pair broke out during the session on Thursday, but the 0.74 level offered a bit too much resistance and we pulled back in order to show that there are in fact quite a few sellers above. With that being the case, I feel that the market certainly has a bit of a ceiling in it at the 0.75 handle. I think that there’s plenty of resistance above, and therefore I have absolutely no interest whatsoever in buying the Kiwi dollar. Besides, the Royal Bank of New Zealand has already told us that it wants to see this pair down to the 0.68 level as it considers it to be “fair value.”

I think that the central bankers in Wellington will get what they want, and it’s only a matter of time before we get down there. With that, I am a seller every time this pair rallies, just as it has done recently. Ultimately though, I think that there will be quite a bit of volatility as the New Zealand dollar is so heavily influenced by the commodity markets which of course have been very volatile.

US dollar

The US dollar is without a doubt one of the strongest currencies in the world right now, and as the commodity markets have been so negative overall, I find it very difficult to think that there’s going to be anything that has me buying the New Zealand dollar against the US dollar anytime soon. I also recognize that the 0.75 level above is massively resistive, so this is a bit of a “perfect storm”, as I think that anytime there is a resistive candle you have to think of it as the market telling you it’s time to start selling again. I also recognize that the 0.70 level below is massively supportive, but will eventually get broken. I believe that’s the target we are working with right now, given enough time. Because of this, I look to the short-term charts for my selling opportunities.