USD/CAD Signal Update

Last week’s signals produced a good profitable long trade off an inside bar bullish break from 1.2625.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades must be made only from 8am to 5pm New York time today.

Long Trade 1

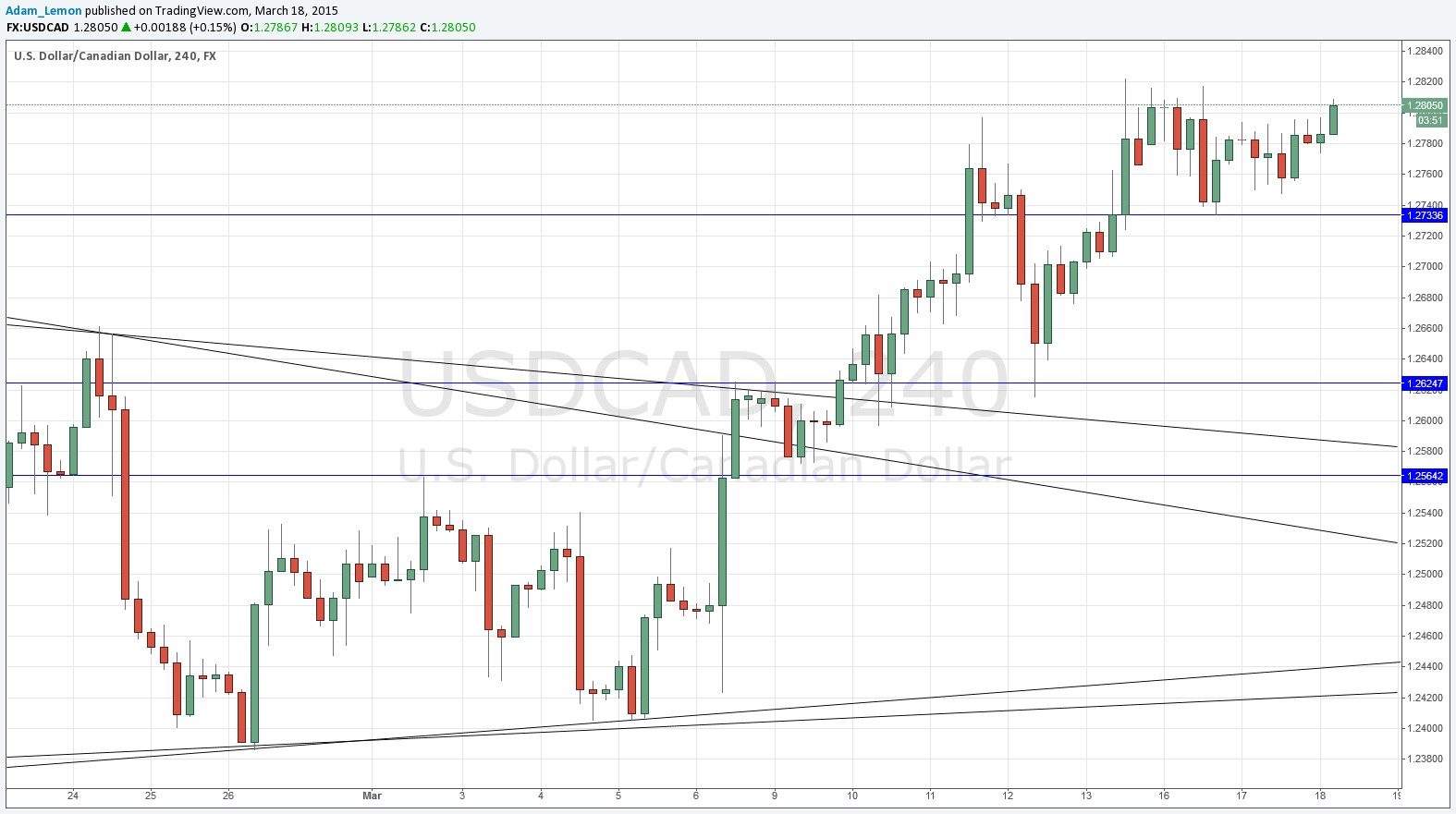

• Go long after bullish price action on the H1 time frame immediately following the next test of 1.2733.

• Place the stop loss 1 pip below the local swing low.

• Move the stop loss to break even once the trade is 20 pips in profit.

• Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

• Go long after bullish price action on the H1 time frame immediately following the next test of 1.2625.

• Place the stop loss 1 pip below the local swing low.

• Move the stop loss to break even once the trade is 20 pips in profit.

• Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CAD Analysis

More than any other USD pair with the possible exception of AUD/USD, this has maintained a USD long bias even while the currency has been slowing down and consolidating ahead of the FOMC data release that will take place tonight. The pair seems to be well placed for a strong upwards move if the FOMC data is positive for the USD.

If the data is not positive, then as we are close to a very long-term high, we will probably fall all the way back to 1.2625.

Unfortunately there seem to be no good supportive levels between 1.2733 and 1.2625.

There are high-impact events scheduled today concerning both the CAD and the USD. Regarding the CAD, there will be Wholesale Sales Data at 12:30pm London time. Regarding the USD, at 6pm the U.S. Federal Reserve will be releasing the latest Federal Funds Rate and FOMC Statement and Projections.