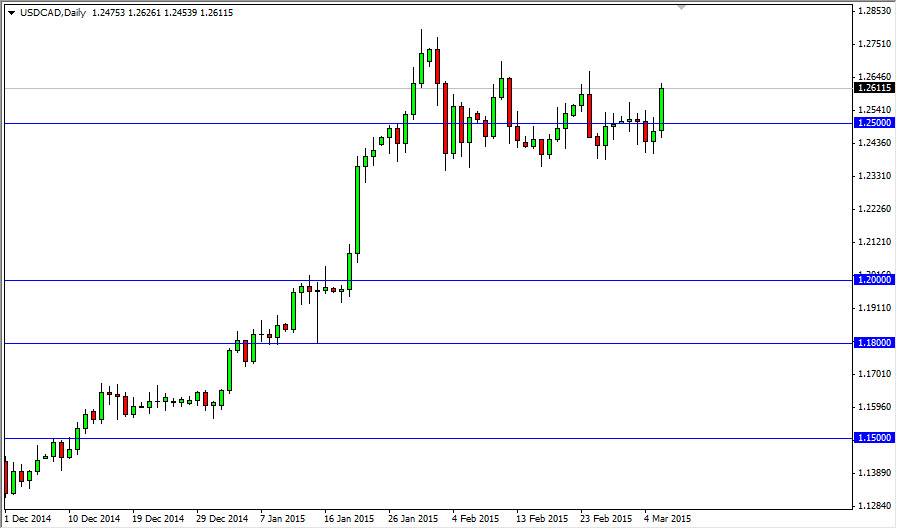

The USD/CAD pair broke higher during the course of the session on Friday, slicing through the 1.25 level, and breaking above the potential down trending line from the possible descending triangle that had been forming. Because of this, I think that the US dollar continues to go much higher against the Canadian dollar, and of course the softer than ideal oil markets are doing the Canadian dollar no favors. Because of this, I am looking to buy this pair every time it pulls back now, and I believe that the 1.24 region is significant support.

On top of that, we had fairly weak Canadian economic numbers during the day, and a stronger than anticipated US jobs number. With that, it’s hard to believe that the markets will continue to favor the greenback, as it continues to be one of the favored currencies by Forex traders around the world.

The safety of US markets.

The safety of US markets still attract money as well, and with the possibility of tightening interest rates, the US dollar should continue to pick up momentum. With that, I believe that this pair will continue to go much higher, and that it’s only a matter of time before we break out to the upside and head to the 1.30 level, where the financial crisis topped out at in this particular currency pair. I believe that it’s going to take quite a bit of momentum to get above the level at 1.30, so several pullbacks may be needed in order to pick up enough momentum to break out. Nonetheless, I do think that’s the longer-term trend for this market, and as a result I firmly believe that we will enter a longer-term buy-and-hold situation soon. Even if we pullback from here, I believe that there is a significant amount of support at the 1.20 level to keep the market somewhat afloat. Supportive candles will be used to buy this market again and again, be it on pullbacks, or dips from a bullish move higher.