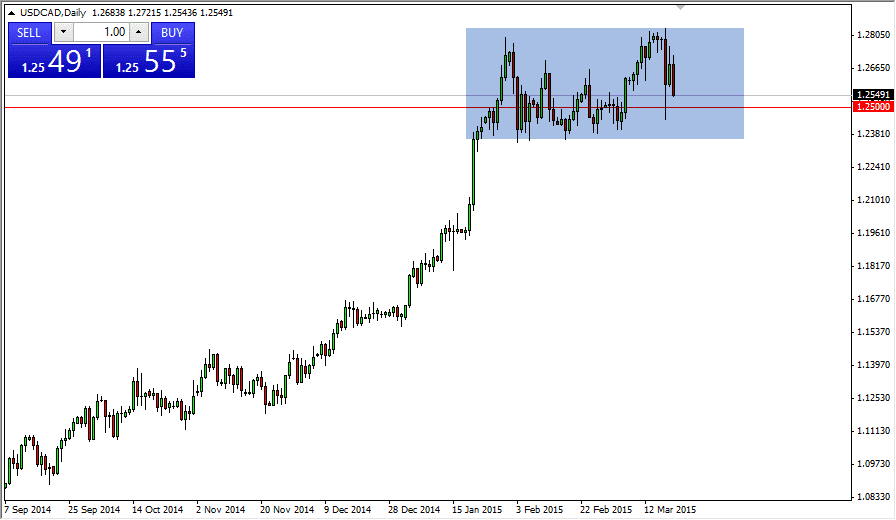

The USD/CAD pair fell during the session on Friday, testing the 1.25 region. There is a significant amount of support below, extending all the way down to the 1.24 level, so I believe that it’s only a matter of time before the buyer step back into this marketplace and try to push price higher. With that being the case, the market looks as if it’s ready to continue consolidating as far as I can see, and I have marked on the chart a light blue rectangle represents the rough range that could come into play.

Remember that the Canadian central bank recently cut interest rates, and as a result the Canadian dollar will continue to be a currency that struggles to find any real strength. That being the case, the market looks as if you can continue to buy the US dollar overall, as it continues to strengthen against most currencies.

Oil markets

The oil markets of course look a bit soft, and that is not going to do any favors for the Canadian dollar. Keep in mind that the oil markets have fallen quite a bit, but even with a bit of a rally I don’t think were anywhere near normalization as far as that market is concerned. As long as that is the case, I think the Canadian dollar is going to struggle against some other currencies, with the US dollar being the most obvious one. Ultimately, I think that we are going to test the 1.30 level, which was where we stopped after the financial crisis several years ago. With that, I believe that originally pulled back mercilessly trying to build up momentum to make that move. Someday, we will break above the 1.30 level and I believe that will be another opportunity to essentially go “buy and hold” in this market going forward. With that being said, I believe that the market is one that you can buy every time it dips and show signs of support.