USD/CAD Signal Update

Last Wednesday’s signals expired without being triggered as the price did not reach 1.2500 that day.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades must be made between 8am and 5pm New York time only.

Short Trade 1

Short entry after bearish price action on the H1 time frame immediately following the next touch of 1.2538.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

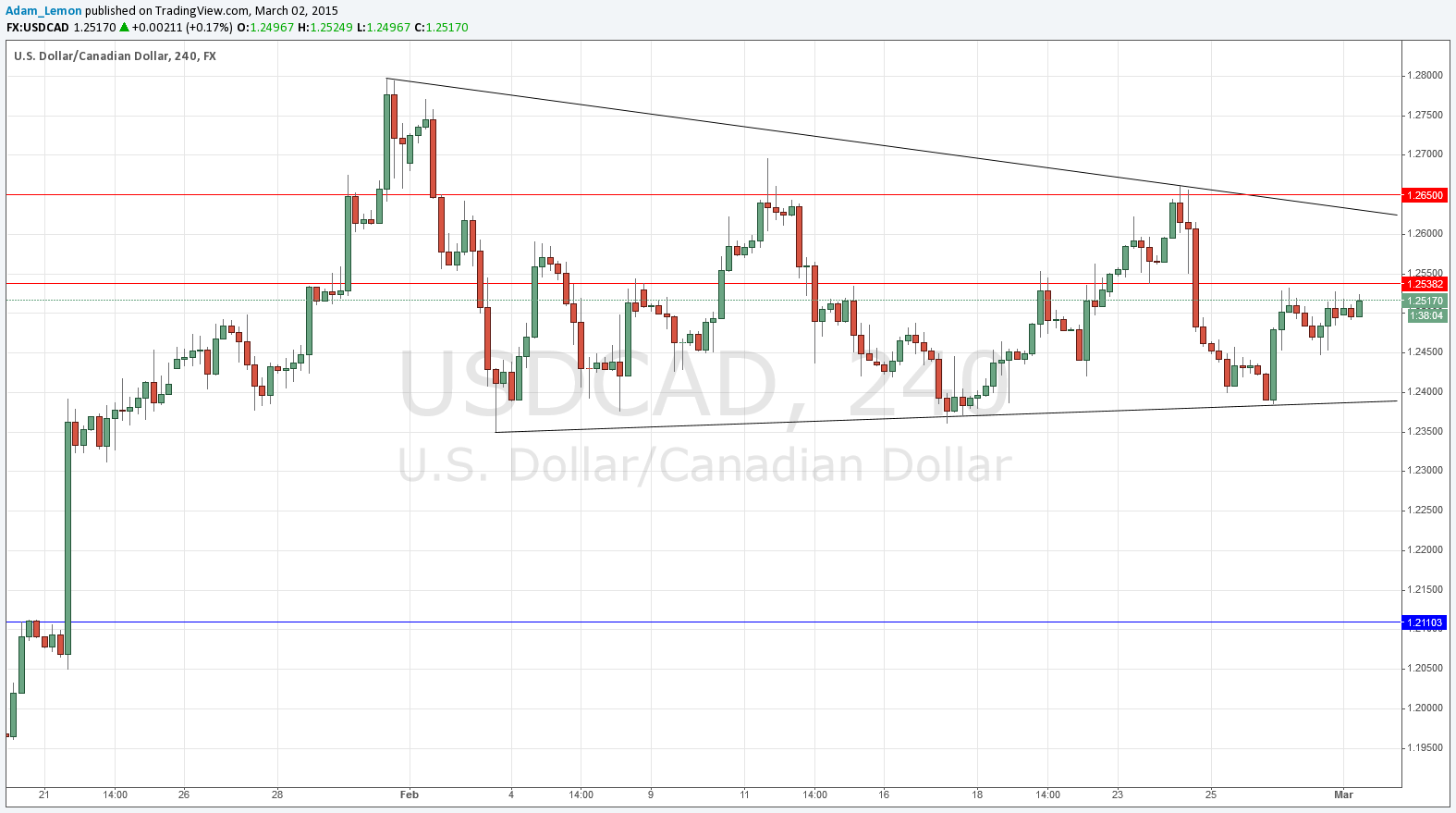

Short entry after bearish price action on the H1 time frame immediately following the next touch of the bearish trend line which currently sites at around 1.2630. If the rejected bullish thrust is also reversing off the 1.2650 level, this will be even better.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 1

Long entry after bullish price action on the H1 time frame immediately following the next touch of the bullish trend line which currently sites at around 1.2390.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CAD Analysis

We had a strong move down that was driven mainly by some surprising CAD strength, but it found support at around the 1.2400 level, forming a bottom that has now produced a stronger supportive bullish trend line, currently sitting just below 1.2400. This suggests we are going to get a move up in the short to medium term, but there is resistance just above at around 1.2538 to 1.2550 which the price would have to break out past. The next obstacle would be the weaker bearish trend line, but this is backed by strong resistance at the 1.2650 level.

Although we had seemed to decisively break out of a triangle with strong bearish direction, the bulls are not defeated yet and are defending 1.2400.

There are no high-impact events scheduled for the CAD today. Regarding the USD, at 3pm London time there will be a release of U.S. ISM Manufacturing PMI data.