USD/CAD Signal Update

Yesterday’s signal was not triggered as the price never reached 1.2544.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades must be made between 8am London time and 5pm New York time today.

Short Trade 1

Go short after bearish price action on the H1 time frame immediately following the next test of 1.2544.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run

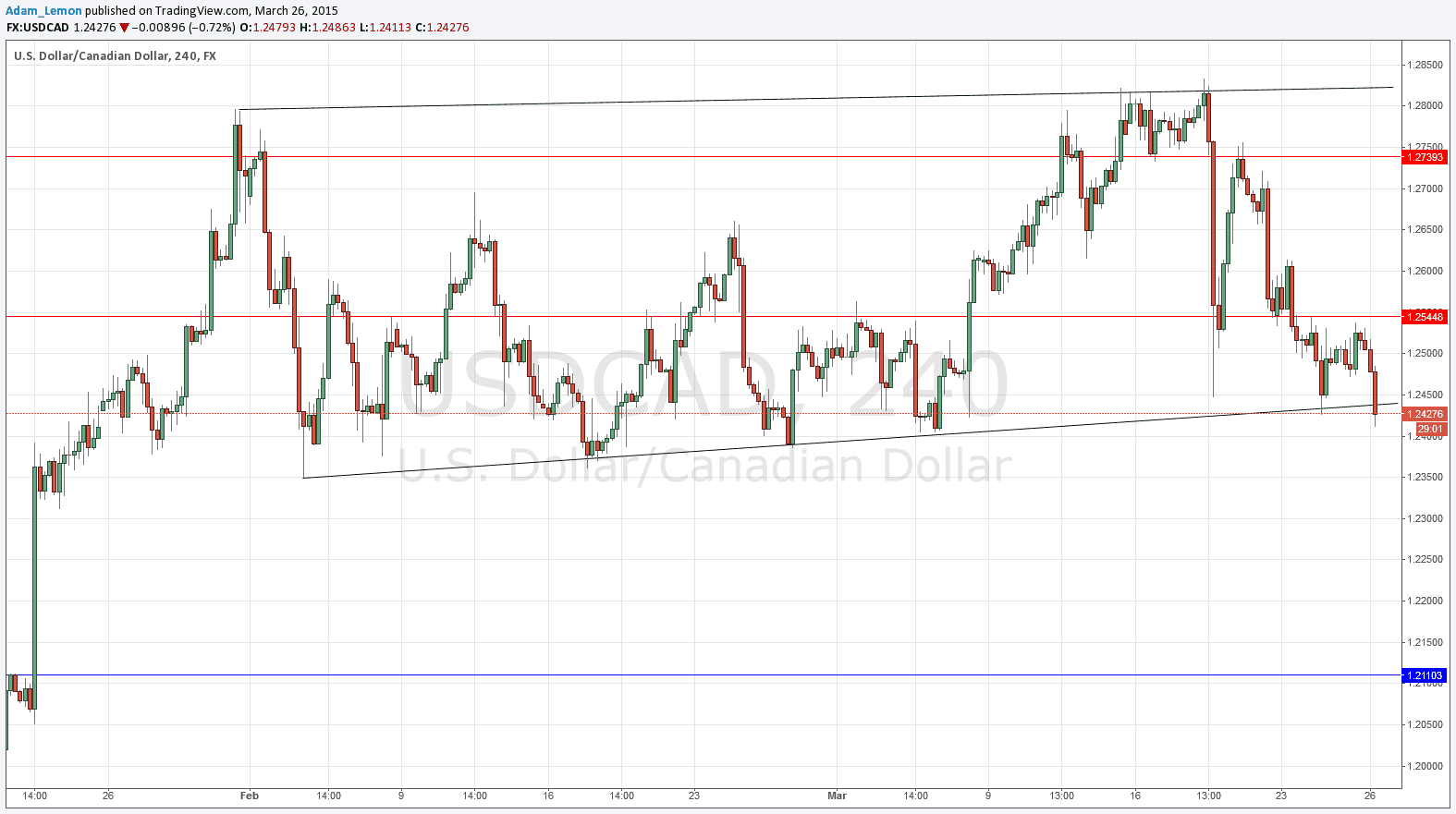

USD/CAD Analysis

The USD is in strong retreat this morning and by default that usually means a kind of bullishness for the CAD as these two currencies are so strongly linked. If you take a look at the chart below, you can see that we have been in a slightly bullish channel for a few weeks now, but the price is currently breaking down below the supportive trend line. I would still look for a short if the price does manage to bounce back up to 1.2544, as muddying this line, especially if 1.2400 breaks down, is a very bearish sign for this pair. In fact there is a “hidden gap” all the way down to about 1.2100, so I currently see no good case for seeking a long, even though the area around 1.2400 has been supportive over the past few weeks.

There are high-impact events scheduled today concerning both the CAD and the USD. Regarding the USD, at 12:30pm London time there will be a release of U.S. Unemployment Claims data. As for the CAD, at 1:30pm London time the Governor of the Bank of Canada will be speaking.