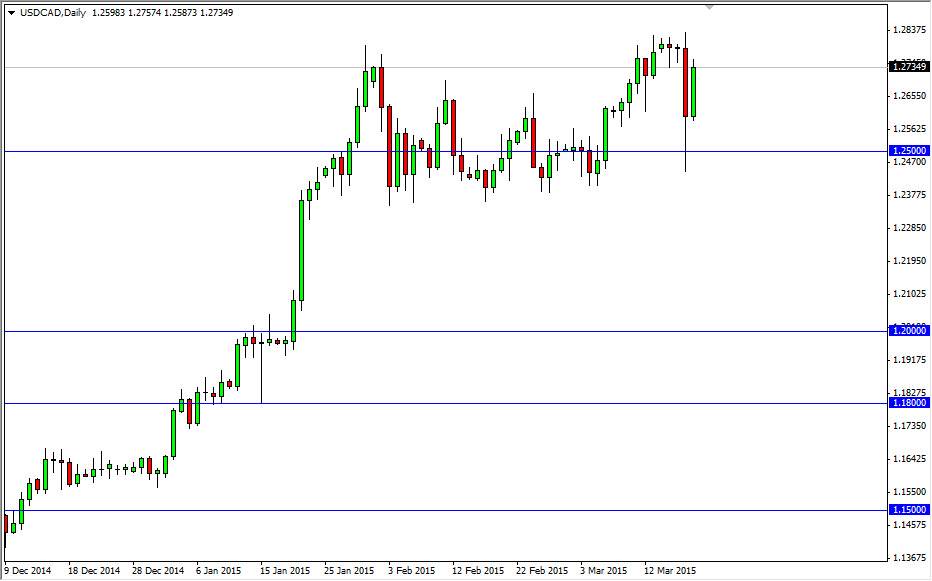

The USD/CAD pair broke to the upside during the session on Thursday, after having such a wild ride on Wednesday. We found enough support near the 120 level to turn things back around, and the fact that the losses are all but recovered at this point tells us that the market more than likely is going to continue the uptrend. I believe that the US dollar will continue to be the favored currency around the world, and that of course will be any different against the Canadian dollar.

Remember that the Canadian dollar is highly influenced by the oil markets, and the of course broke down during the session on Thursday as well. With that, I believe that every time this market pulls back it will be looked at as value, and people will swoop in to pick up the US dollar. I also believe that the 124 level offers a bit of support, and as a result I believe that pullbacks will be stalled in that general vicinity.

Oil markets continue to disappoint

Oil markets in general continue to disappoint, and that of course is going to work against the value the Canadian dollar. In fact, I believe that the Light Sweet Crude market is going to continue to drop much farther, and as a result there’s really no way to anticipate that the Canadian dollar is going to strengthen. The Bank of Canada recently cut rates in an interest rate decision surprise, and as a result there won’t necessarily be a lot of trust in the Canadian economy as well.

Ultimately, it’s very likely that this market continues towards the 1.30 handle, although it won’t necessarily be easy to get there. There is a lot of noise above, and remember that the 1.30 level above is where the market stopped during the financial crisis, and in fact was stymied several times in a row. With that, I believe that the market needs to build up momentum to break out, and as a result it may be very choppy with an upward bias in the near term.