USD/JPY Signal Update

Last Thursday’s signals were probably not triggered, unless a long was taken off a retested trend line that was mentioned, in which case it would probably be wise to close most of it for profit if not already done so.

Today’s USD/JPY Signal

Risk 0.75%

Trades may only be taken between 8am London time and 5pm New York time only, or after 8am Tokyo time later.

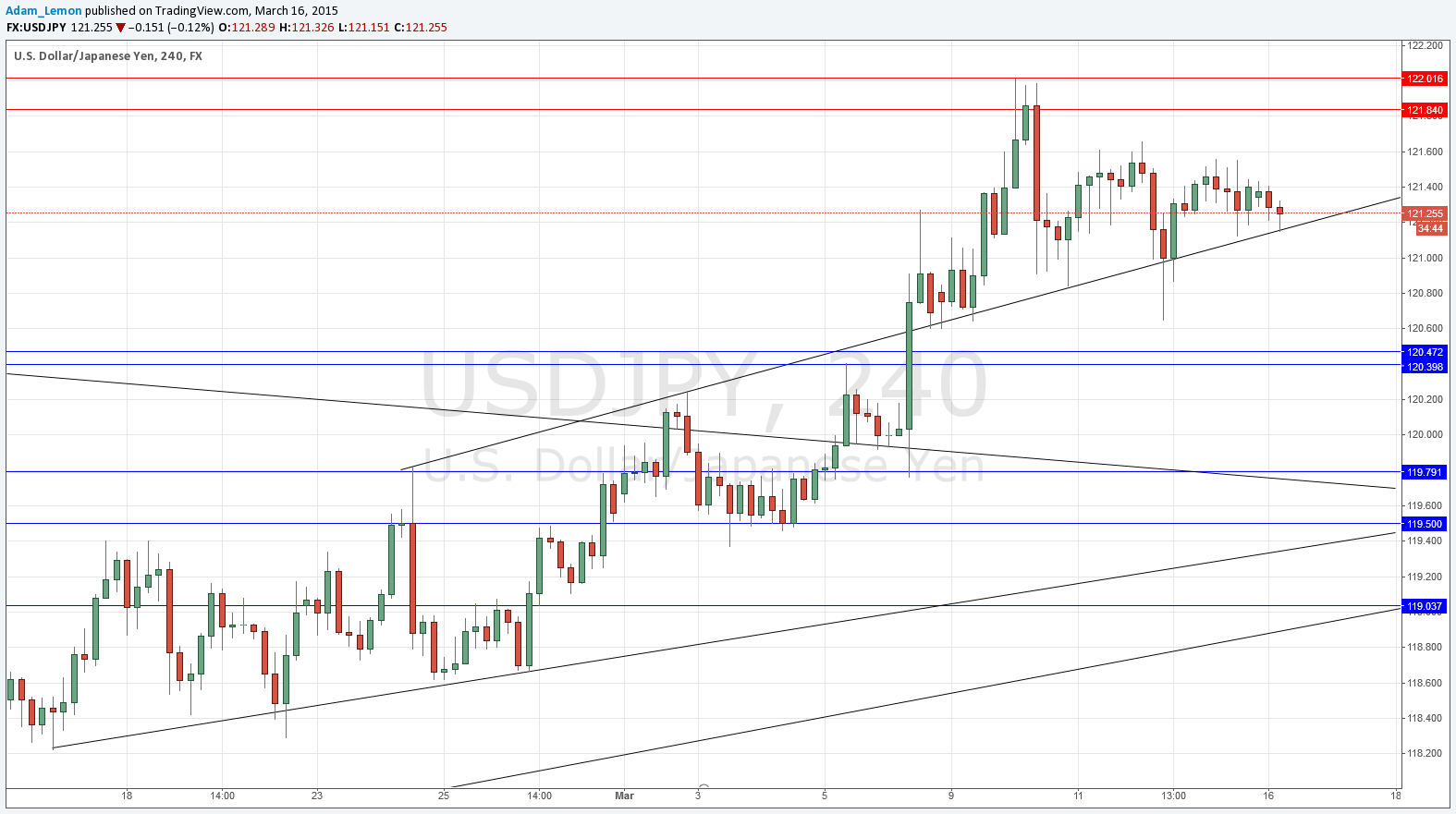

Short Trade 1

Short entry following some bearish price action on the H1 time frame immediately upon the next entry into the zone between 121.84 and 122.00.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 1

Long entry following some bullish price action on the H1 time frame immediately upon the first test of the zone from 120.47 to 120.39

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

Long entry following some bullish price action on the H1 time frame immediately upon the first test of 119.79.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

I forecast last Thursday that if the bullish trend line held the price should continue upwards. It did hold, but only just, and although it is still barely holding this morning, it looks a little shaky right now. It may be that the market is awaiting the Bank of Japan late in the forthcoming Tokyo session, and that not much will happen before then. In any case I do not see the current bullish trend line action as strong enough to warrant a long. There should be no new positions as long as the price remains between 121.84 and 120.47, and ideally they would be taken after the Bank of Japan’s Statement is released later.

My colleague Christopher Lewis disagrees with my positional flexibility: he is buying only.

There are no high-impact events scheduled today concerning the USD. Concerning the JPY, very late in the Tokyo session there will be a release of the Bank of Japan’s Monetary Policy Statement, which is likely to affect the JPY.