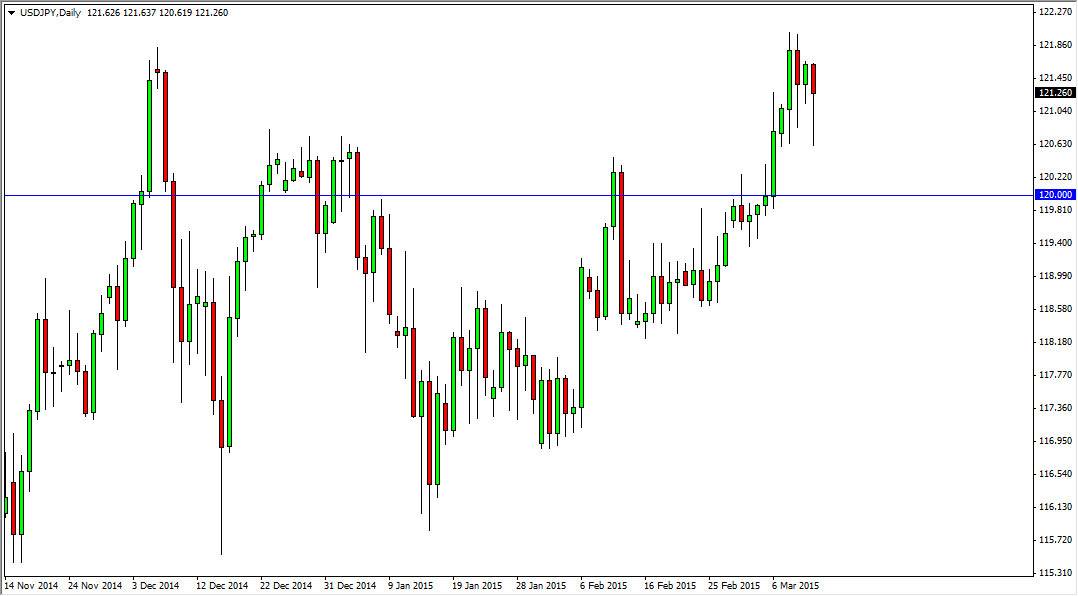

Looking at the USD/JPY pair, you can see that we initially fell during the day on Thursday. However, we found enough support below the 121 level to turn things back around and form a nice-looking hammer. That hammer of course is a good sign that the uptrend is going to continue over the longer term. Also, looking at this pair, you can see that we have been going higher for some time, and as a result the only thing that I can do is buy.

Ultimately, the US dollar is a currency that I think will continue to be favored over most currencies around the world, so it’s almost impossible to imagine selling this pair. The interest-rate differential should continue to expand, and therefore have more money flowing from left to right as far as the Pacific Ocean is concerned.

Bank of Japan

I believe that the Bank of Japan will continue its loose monetary policy for the foreseeable future, while the Federal Reserve continues to tighten its monetary policy through a simple exit of quantitative easing, and perhaps even some interest-rate increases over the next year or so. Nonetheless, this is a market that is a bit of a one-way trade, and I believe that if we can get above the 122 handle, is market should then head to the 125 level.

I believe that the 120 level below is massively supportive, and should be a bit of a floor so that the buyers can use it to bounce off of every time we pullback. Remember, when we pullback in this pair you have to consider it as the US dollar being on sale, and that of course invite more buying. Ultimately, I think that the 125 level gets hit in the next month or two, and then we break out above there. That will more or less make this a buy-and-hold scenario as more and more people will get involved every time this pair dips. I have absolutely no scenario in which I sell this pair.