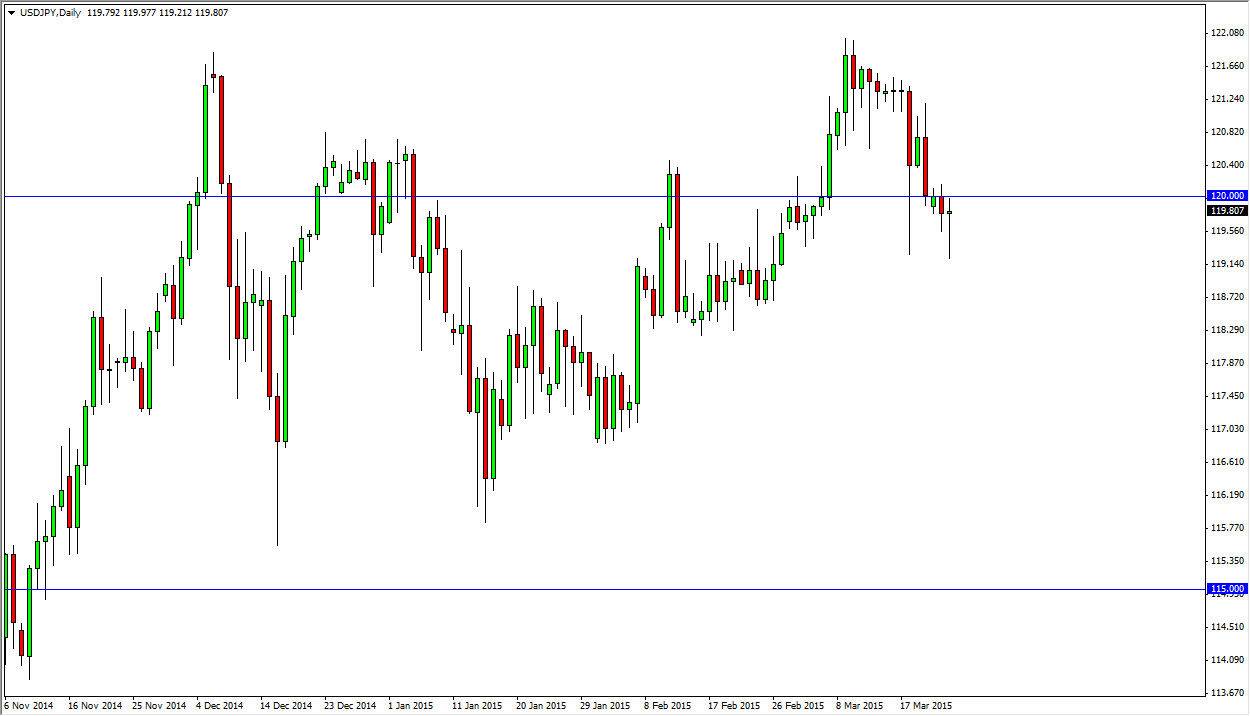

The USD/JPY pair initially fell during the course of the session on Tuesday, but found enough support near the 119 level to turn things back around and form a nice-looking hammer. The hammer of course is a very bullish sign overall, and the fact that the top of the hammer sits right at the 120 handle has me thinking that the market is in fact getting ready to bounce yet again. If we can break above the 120 level, I feel at that point time it’s a decent buying opportunity as the market should then head to the 122 level given enough time. If we can break above there, then I believe we had to the 125 level, which is a longer-term target of mine anyway.

Are we starting to see a longer-term trend again?

I believe that eventually we could be getting ready to see a nice longer-term trend form. I think that pullbacks will continue to offer buying opportunities, and the candle on Tuesday is just that type of pullback and signal that I will be looking for. On the other hand, if we break down below the bottom the hammer, I think that we will find plenty of support below and I will look to start buying somewhere else. I don’t really have any interest in selling, because quite frankly the US dollar is one of the strongest currencies in the world right now, and I don’t necessarily want to start buying the Japanese yen as the Bank of Japan will continue to fight any Yen appreciation going forward.

Going forward, it’s only a matter of time before we break out in my opinion, so really I have no interest in selling and think that I will get my opportunity to start going long in this marketplace going forward, and that it is a marketplace that could be one that you could find yourself in a “buy-and-hold” situation for the longer term as well.