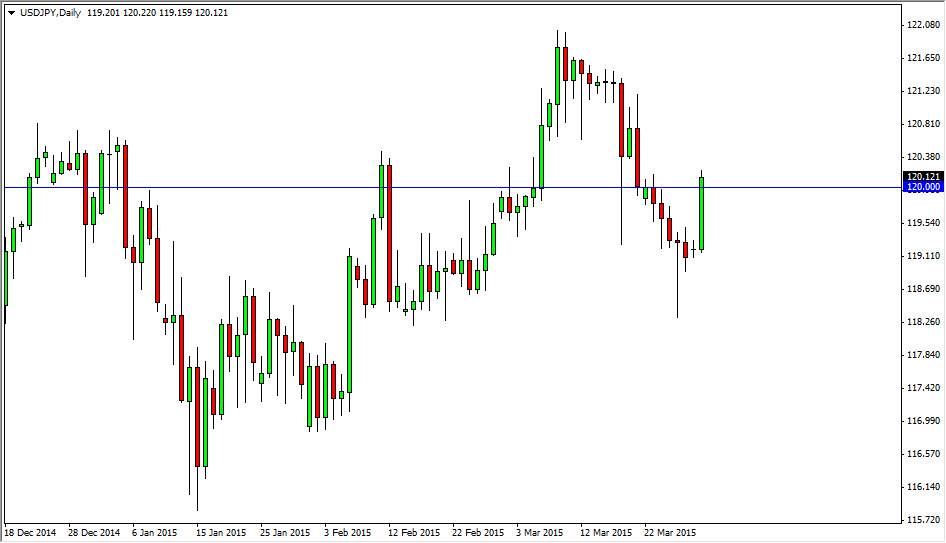

The USD/JPY pair rose during the session on Monday, slicing through the 120 handle. The move was very bullish, and as a result we ended up closing at the very top of the range. With that being said, I believe that pullbacks will continue to be buying opportunities as this market certainly looks very peppy. If we can break the top of the range for the session on Monday, this market should then go to the 122 handle. I believe that this market will continue to offer buying opportunities every time it pulls back, and that includes from here.

Ultimately, I believe that this market goes to the 125 handle, and that the difference between the central banks continues to push this market higher. After all, the Bank of Japan continues to keep a very loose monetary policy, while the Federal Reserve has completely step away from the quantitative easing game. With this, the market now appears as if it is a “buy only” situation.

[CAD:FXAcademy CTA #73]I continue to buy dips

I believe that the only way to play this market is to buy short-term dips that show signs of support. After all, the market will continue to offer buying pressure underneath, as the market grind much higher. Ultimately, the market looks like it is bullish overall and that it’s only a matter of time before we break out to the upside. This being the case, I don’t see any ability to short this market, as I think there will be far too many buyers underneath. Ultimately, I believe that the 118 level is a bit of a “floor” in this market, and that should continue to keep the US dollar somewhat afloat.

Over at the US Dollar Index, you can see that the US dollar continues to look very strong, and as a result I have no interest in selling it against anything. The Japanese yen of course will be any different, and I do believe that we are beginning a long-term rally.