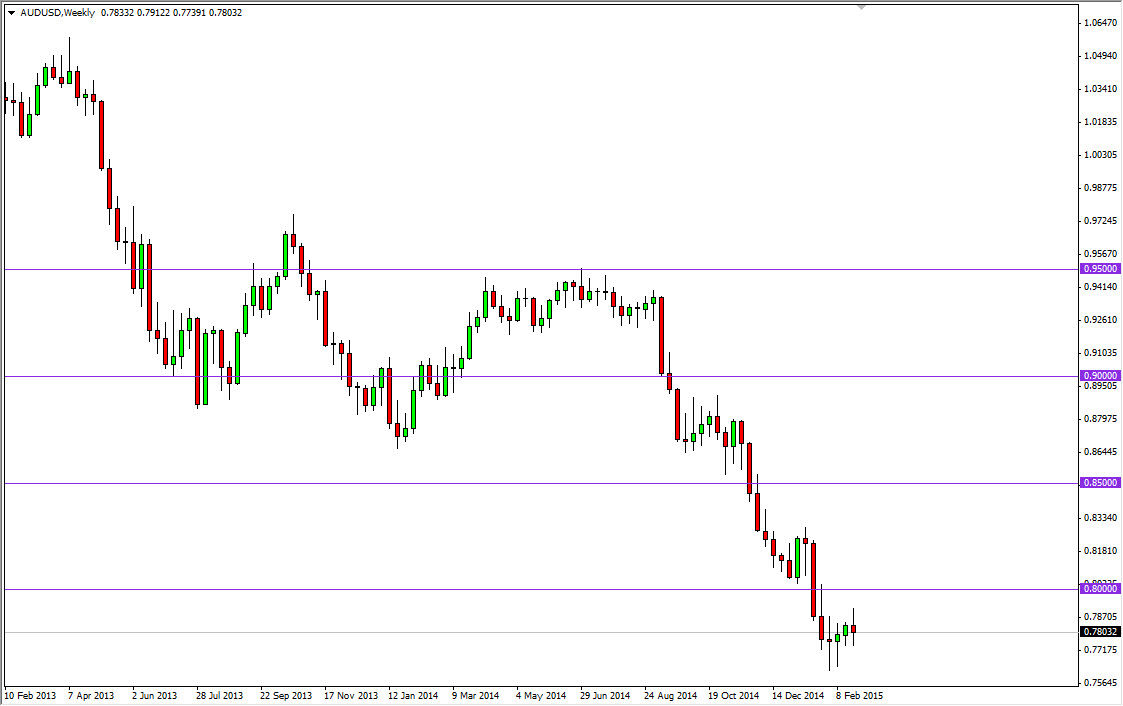

AUD/USD

The AUD/USD pair went back and forth during the week, and I think that we are probably going to see a slight bounce now. However, the downtrend is still in play, and I will look at those bounces as selling opportunities going forward. I cannot buy the Aussie at this time, as I think there is a massive barrier of resistance at the 0.80 level. In fact, I think that area offers resistance all the way to the 0.83 level.

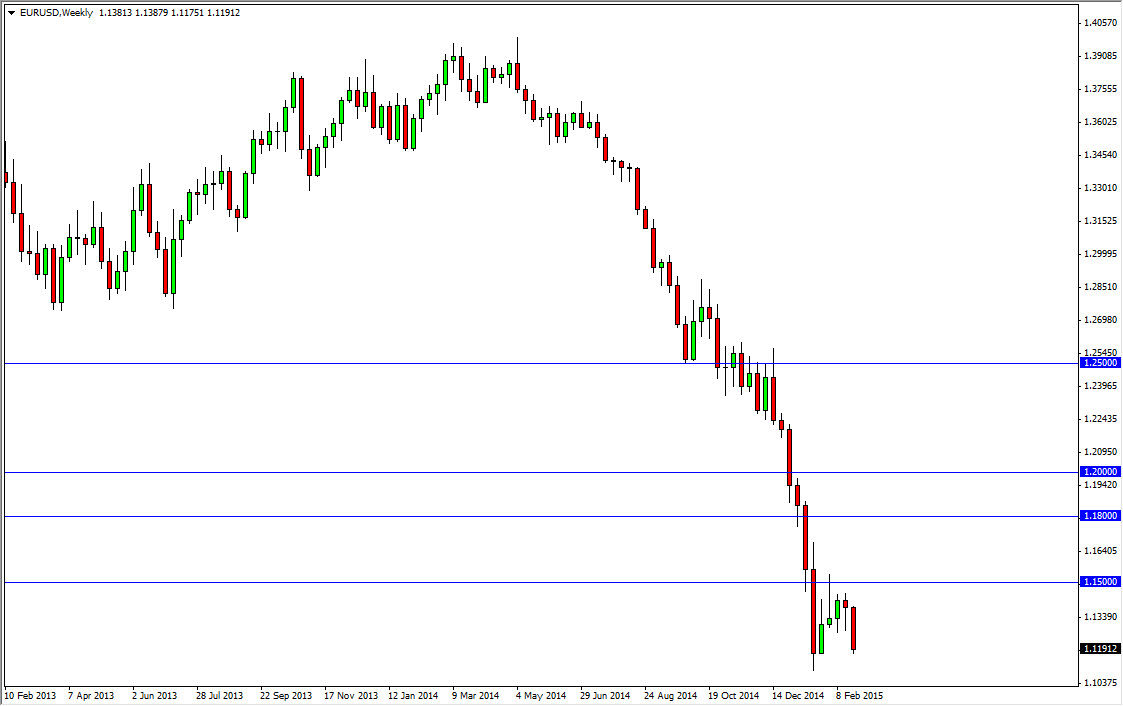

EUR/USD

The EUR/USD pair fell hard during the previous week, and I think this will continue. Yes, this trade is a bit crowded at the moment, but I see no reprieve for the Euro, and I think that we are still going to try to reach the 1.10 level soon. In fact, the Friday session formed a shooting star at the bottom of a move lower, which is very, very bearish to me. I think that rallies continue to offer selling opportunities in this pair.

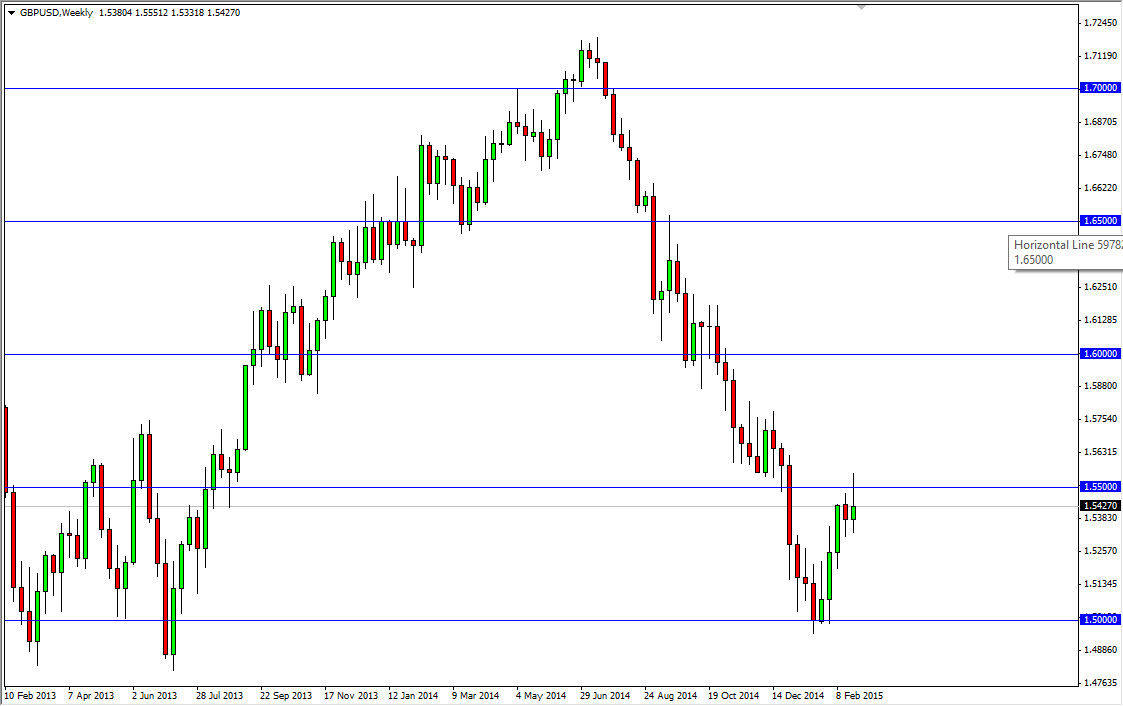

GBP/USD

The GBP/USD pair offered a shooting star at the end of the week, and as a result I think it is only a matter of time before we break down again. This should offer a move down to the 1.50 level given enough time, but I do see a bit of support at 1.53 that might slow that move a slight bit. In the end though, this pair continues to fall, and bounces are to be considered value in the Dollar.

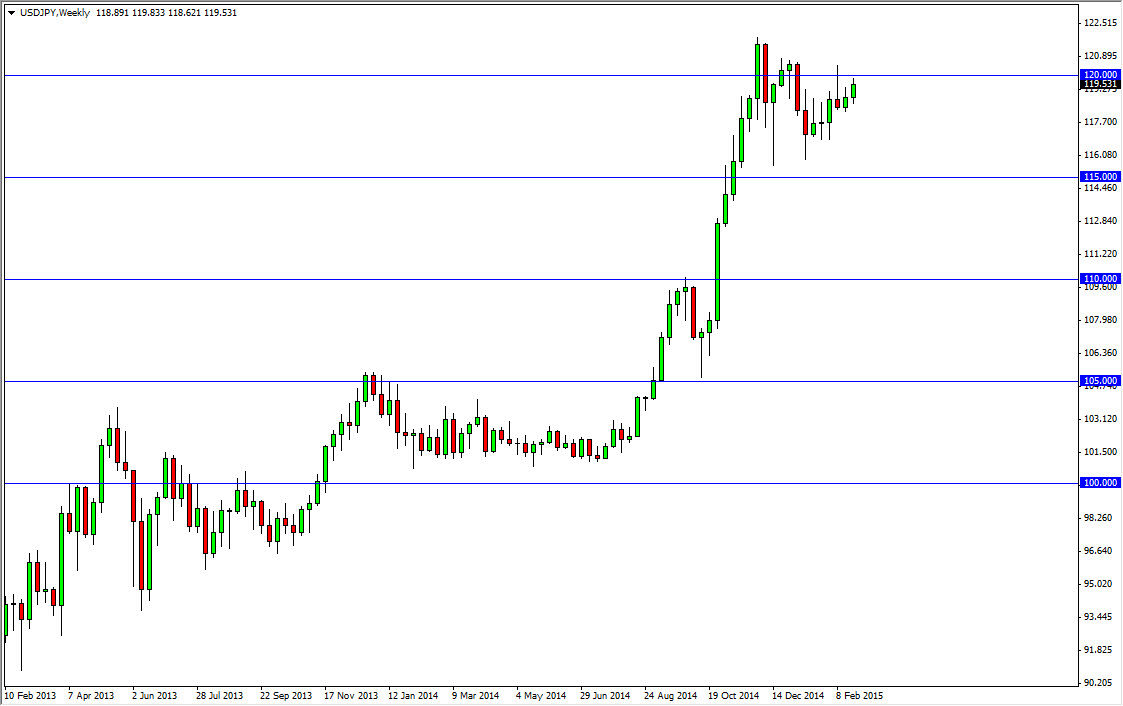

USD/JPY

The USD/JPY pair went a bit higher during the past week, and is currently pressing against the 120 level. This is an area of resistance, but I think we break above there this week. The market should find enough buying pressure underneath to continue the move even higher, but I also recognize that it will be choppy trading. Although I believe this market is in a longer-term buy and hold phase, that doesn’t mean that there won’t be volatility. There most certainly will be.