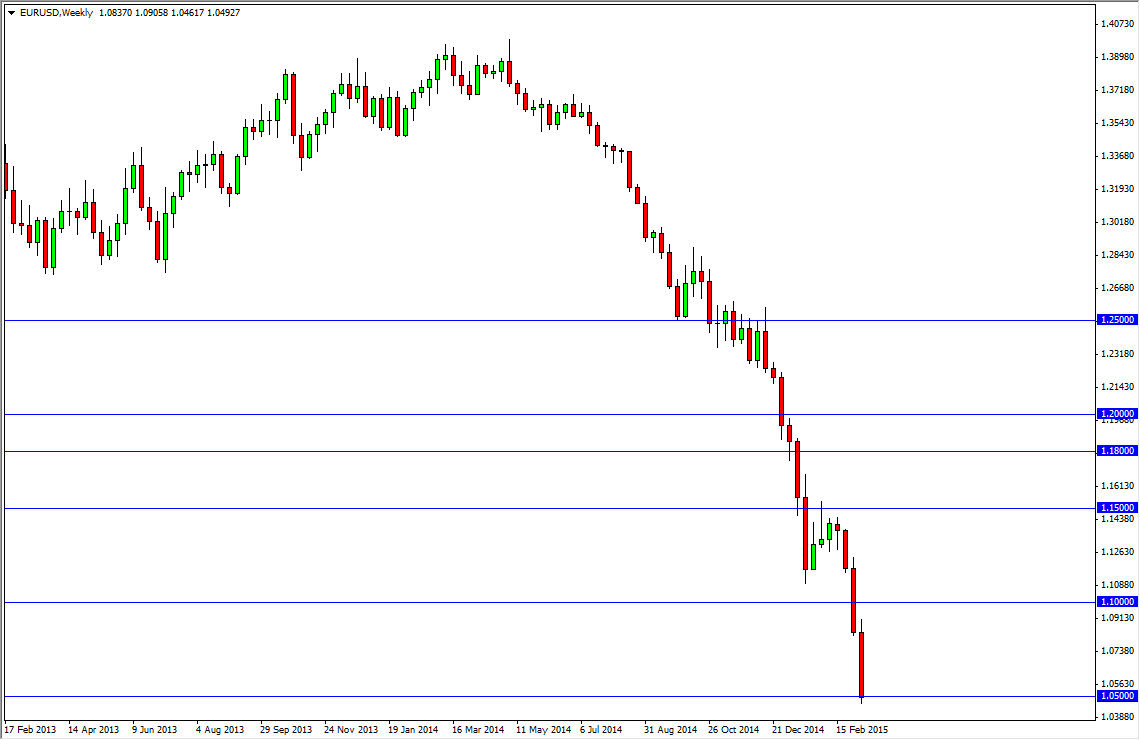

EUR/USD

The EUR/USD market fell apart yet again during the session this past week, slamming into the 1.05 level. While this is a large, round, psychologically significant number, I don’t see anything on this chart that even remotely suggests that we can’t break down below there. I think this pair goes the parity, and that every time it rallies you’re going to have to be thinking about selling it yet again. Ultimately, the 1.10 level should be resistive as well.

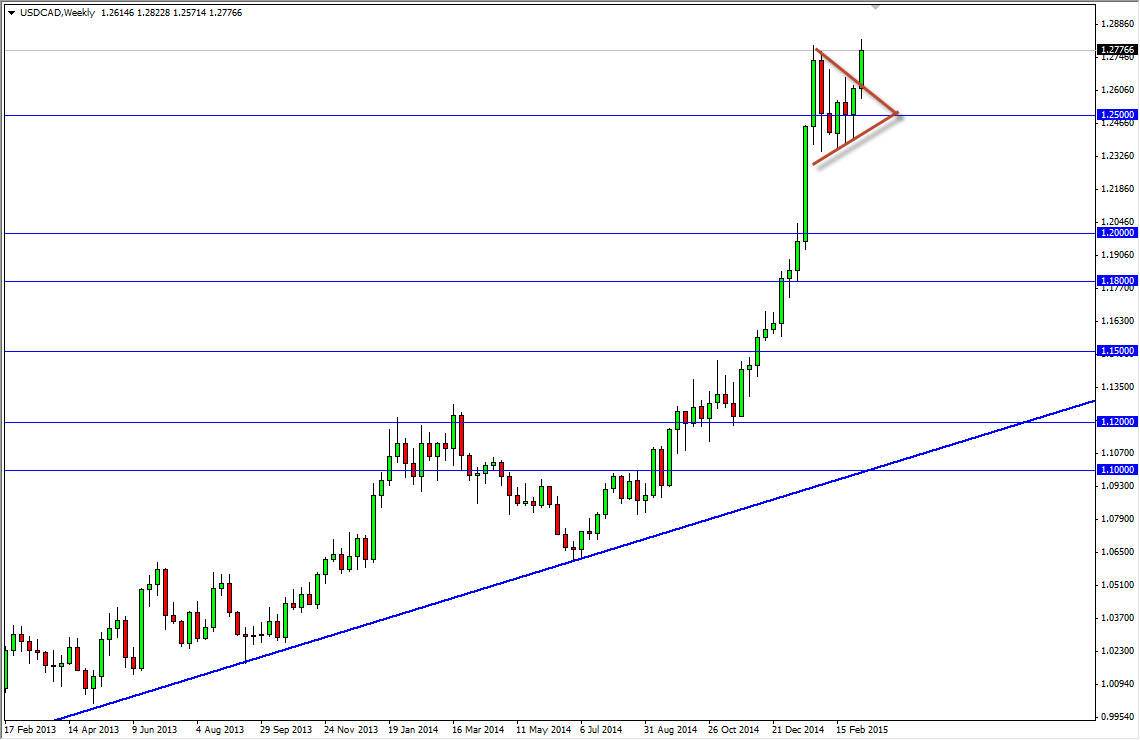

USD/CAD

The USD/CAD pair broke higher during the course of the week, as we continue the bullish move that we have seen for some time now. Ultimately, I believe that the US dollar will slam into the 1.30 level, an area that had been massively resistive in the past, namely during the financial crisis. If we can get above there, this pair will go much, much higher. I do think though that it’s going to take a couple of attempts to break out above there, so look for pullbacks in order to get involved in what looks to be a very bullish market.

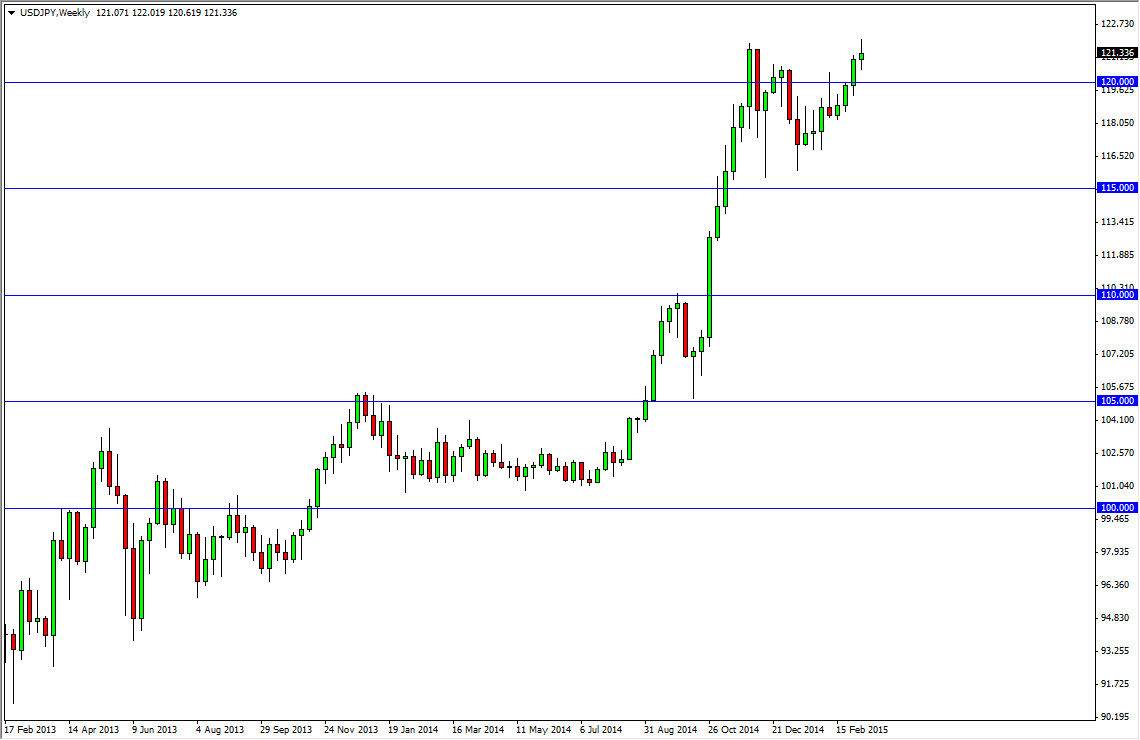

USD/JPY

The USD/JPY pair had a fairly benign week, but we did break out to the upside at one point in order to at least show that there is quite a bit of bullishness still in there. I believe that if we can take the market above the 122 handle, we are going to head to the 125 level. Between here and there, I see plenty of support below so look at pullbacks as value in the US dollar as we continue to grind much higher.

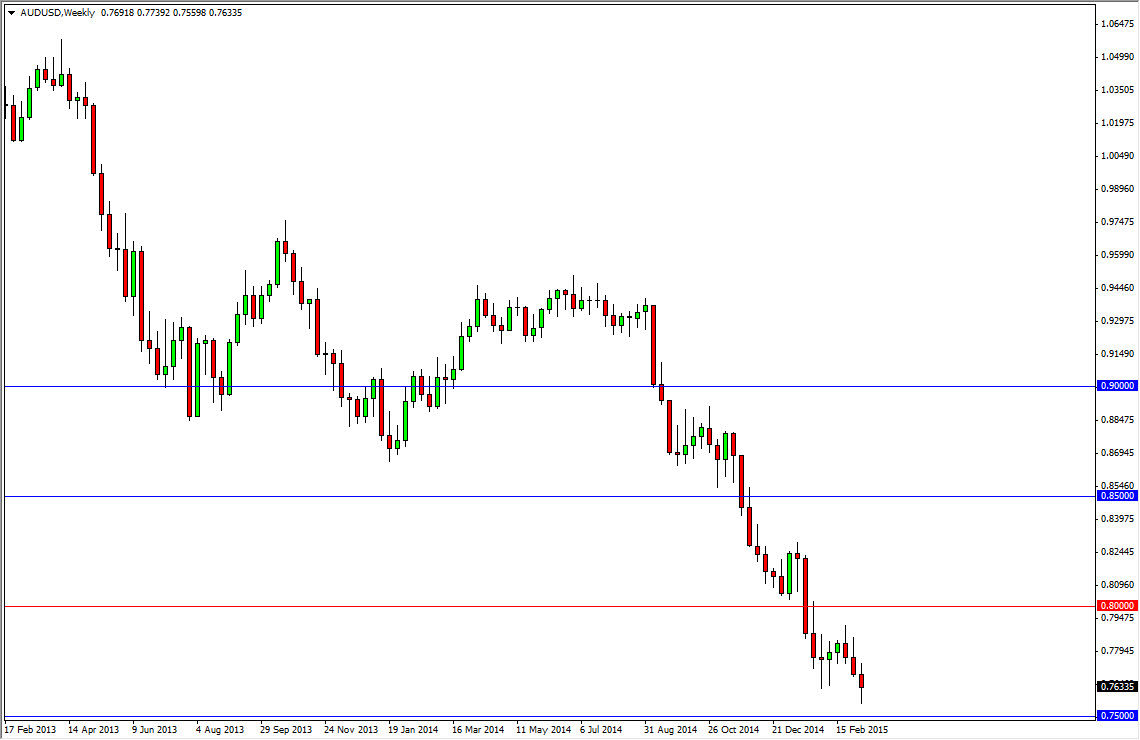

AUD/USD

The AUD/USD pair went back and forth during the week, and while it did not form a hammer, it’s suggested that we are going to have a bit of a fight to get below the 0.75 level. Nonetheless, I look at this as a market to short every time it rallies, and I do think that eventually we will get below the 0.75 handle but it may take a little bit of grinding. Nonetheless, maintain a very bearish stance.