EUR/USD

The EUR/USD pair tried to rally during the course of the week, but as you can see we struggled to get above the 1.10 level for any real length of time. Because of this, I feel that the market is ready to continue selling off overall, but I recognize that the market might be a little bit tight for longer-term trades. This is mainly because I see support at the 1.05 handle, so I think that this is more or less going to be one of those situations or short-term traders will continue to sell, but longer-term traders may be locked out.

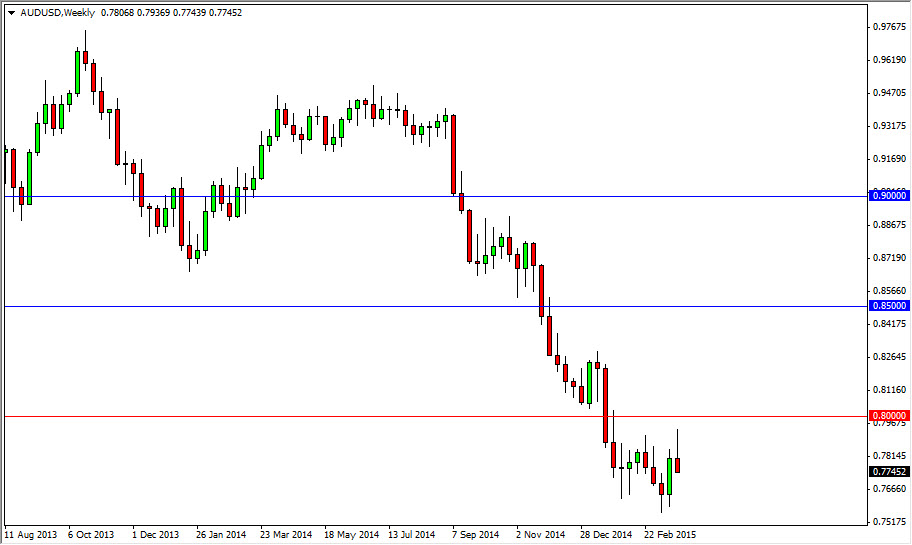

AUD/USD

[CAD:FXAcademy CTA #121]The AUD/USD pair tried to rally as well, but turned back around at the 0.80 handle. Looking at this chart, it ended up forming a shooting star which of course does suggest that we are going to go lower. However, I believe that the 0.75 level is going to be somewhat supportive. Ultimately, I think the market goes much lower than that, and I have the 0.80 level on this chart as a red line suggesting that it is the ceiling at this point.

[CAD:FXAcademy CTA #121]USD/CAD

The USD/CAD pair fell during the course of the week, breaking below the 1.25 level. However, the 1.25 level below there is the actual bottom of the support, so the fact that we bounced from there and formed a hammer of course it doesn’t surprise me much. I believe that we are going to grind away between the 1.24 level and the 1.28 level over the next couple of weeks. However, I do believe that eventually we will test the 1.30 level, where the financial crisis ended up pushing this market. We couldn’t get above there last time, but I do think that we are going to make at this time.

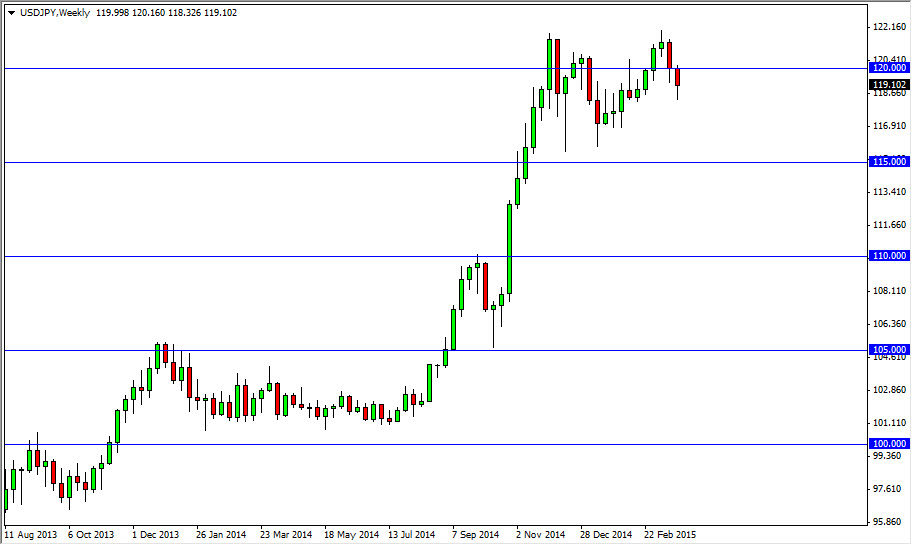

USD/JPY

The USD/JPY pair pulled back during the course of the week, but found enough support at the 118 level. This is an area that offers support, and as a result we ended up bouncing enough to form a bit of a hammer. With that being the case, we feel that a move above the 120 level should continue to drive this market higher, as it appears we could possibly be making an ascending triangle. At that point in time, I anticipate seeing this market head to the 122 level, and then the 125 level.