GBP/USD

The GBP/USD pair fell hard this past week, as it approaches the 1.50 level. This is a major area of support though, so I wouldn’t be surprised to see buyers come into this market again. The massively long and bearish candle should be a sell signal – but the support at 1.50 extends all the way to the 1.48 handle. Because of this, expect a bounce in the short-term.

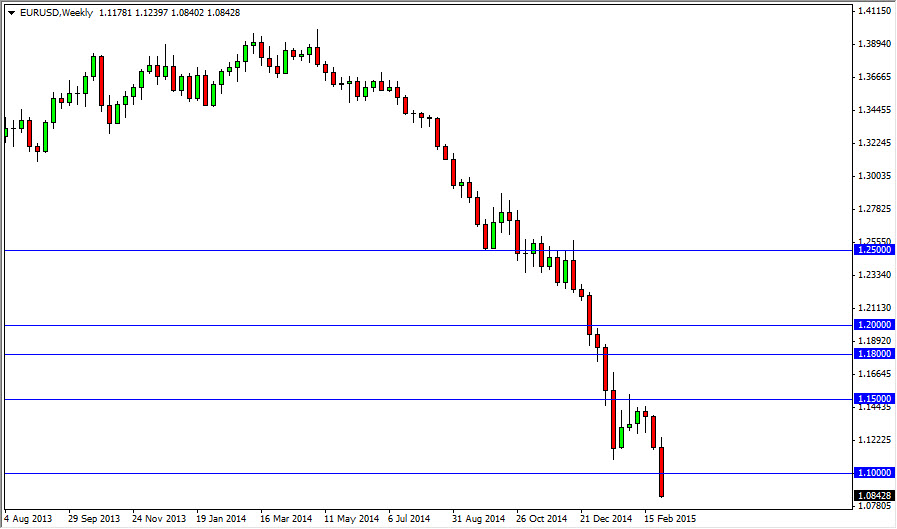

EUR/USD

The EUR/USD pair broke down this past week, finally clearing the 1.10 level to the downside. The market continues to struggle with the EU suffering possible deflation, and the ECB willing to take extraordinary measures for liquidity. The policy should continue to be very loose, and this of course should drop bonds yields in the EU – making the Euro very, very soft. I am a seller of short-term bounces, as they will represent value in the US dollar.

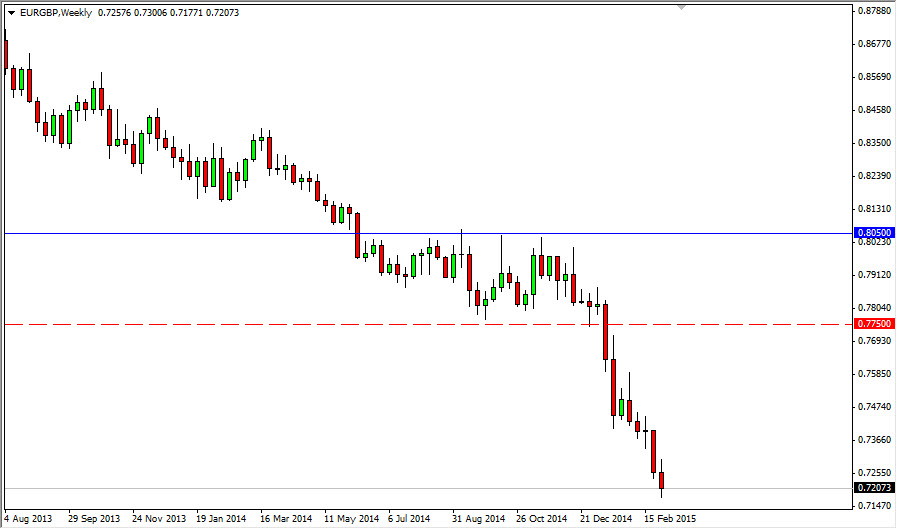

EUR/GBP

The EUR/GBP pair fell a bit during the week, but looks a bit supported on the daily chart. Because of this, I think there will be a bit of a bounce, but it will only offer another opportunity to sell the Euro again. The Pound got hammered against the US Dollar on Friday, but it isn’t the Euro – and that’s enough of a reason to keep selling as the trend is well set, and looking stronger over time.

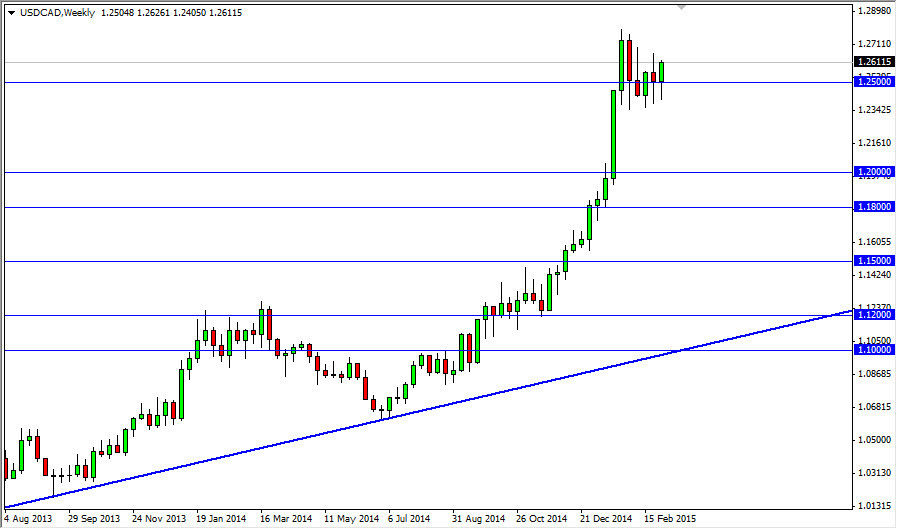

USD/CAD

The USD/CAD pair had been forming a descending triangle for some time. However, we broke out to the upside on Friday, clearing the potential down trending line, and this should continue the upward movement as the pair looks set to head to the 1.30 level. The oil markets continue to work against the CAD, and as a result – I am still very bullish of this pair…..but understand it will take something a bit special to break above the 1.30 handle.