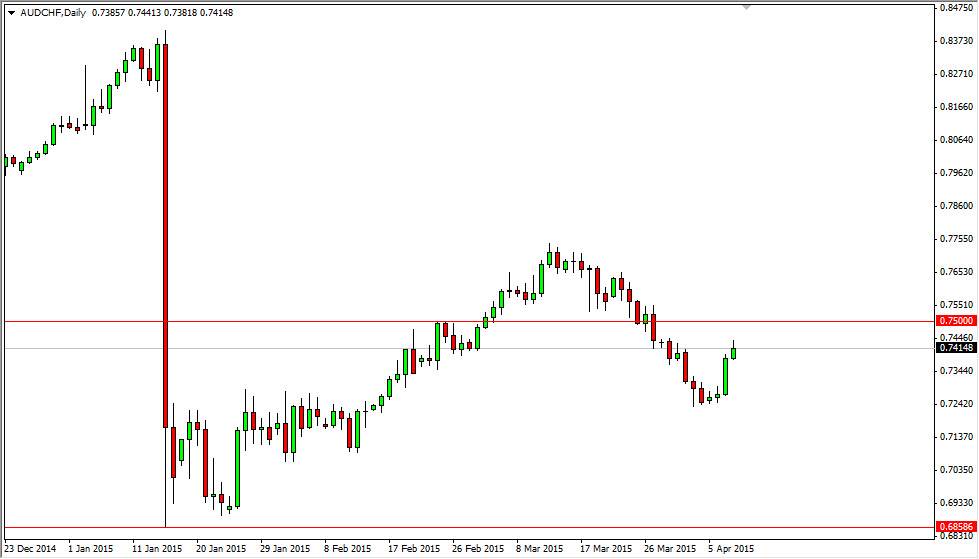

The AUD/CHF pair tried to rally during the session on Wednesday, but failed to hang onto the gains by the end of the day. The market sits just below the 0.75 level, which I believe will continue to be resistive in this particular pair. The candle shape from the session on Wednesday is a bit of a shooting star, and this should find a lot of “weight” on it in this region. The Swiss franc continues to be a weird currency to deal with, but I think this market is more or less moving on the Aussie at the moment. The Aussie will continue to struggle overall, and as a result I am not buying it. Not even here.

The rallies going forward should continue to find sellers as there is far too many issues with the commodity markets, and the Aussie of course is influenced heavily by them. The markets around the world are showing signs of weak commodities, and with the Aussies being so attached to the gold markets, and other hard assets, so I have a hard time buying the AUD in general.

AUD/USD showing signs of resistance above

The AUD/USD is the best barometer of overall Aussie strength or weakness, and right now it looks like we are running into a bit of resistance above. Besides, the pair is decidedly bearish, and I think it is going to be some time before we see it break above the 0.80 level, which is where I would have to rethink my ideas when it comes to the Aussie dollar in general. I think that in general commodities are going to continue to be very soft, and that unless we see some type of massive change in Asia, the Australians will continue to show signs of weakness. In fact, we have recently seen the Reserve Bank of Australia state that the global economy is showing signs of weakness, and have not ruled out rate cuts. In other words, I’m avoiding the Aussie altogether. If we break down below the bottom of the range for the session on Wednesday, I’ll be selling.