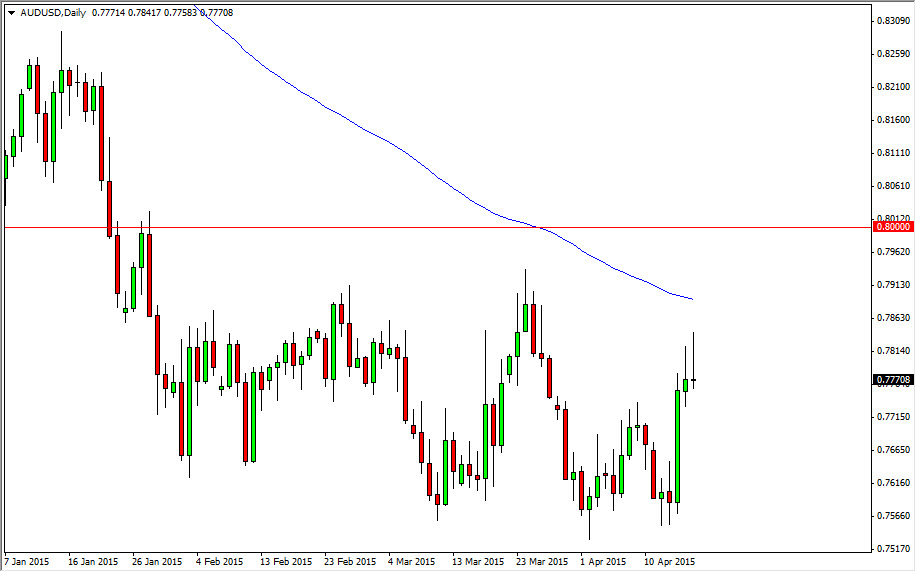

The AUD/USD pair initially tried to rally during the course of the session on Friday, but as you can see pulled back from the 0.78 level. That being the case, we ended up forming a perfect shooting star. On top of that, the shooting star was the second shooting star in a row on the daily chart, so it tells me that this market is most certainly going to turn back around given enough time.

Top of that, we have the 100 day EMA just above, and as a result I think that the longer-term trend traders will continue to sell off the Australian dollar as well. With this, I feel that the market should then go down to the 0.76 level where it will find support yet again. Ultimately, I think it breaks down below there so given enough time. I think that the Australian dollar is going to continue to suffer at the hands of the commodity markets which are going to be soft the longer term, but have had a nice rally recently.

Gold markets

Gold markets are necessarily helping the Australian dollar either, as a result I think that the Aussie really has no business going higher. On top of that, I believe that the 100 day EMA and the 0.80 level above should continue to keep this market somewhat at bay. Because of this, I believe it’s only a matter of time before the sellers step in and the fact that we have formed to shooting stars makes me believe it will be today.

If we can break below the bottom of the shooting star for the Friday session, I would be a seller. On top of that, I think that the market should continue to go lower but I recognize that the impulsive candle from Wednesday should continue to try to support this market. Because of that, I don’t know necessarily that the move lower will be easy, but I do think that it’s coming.