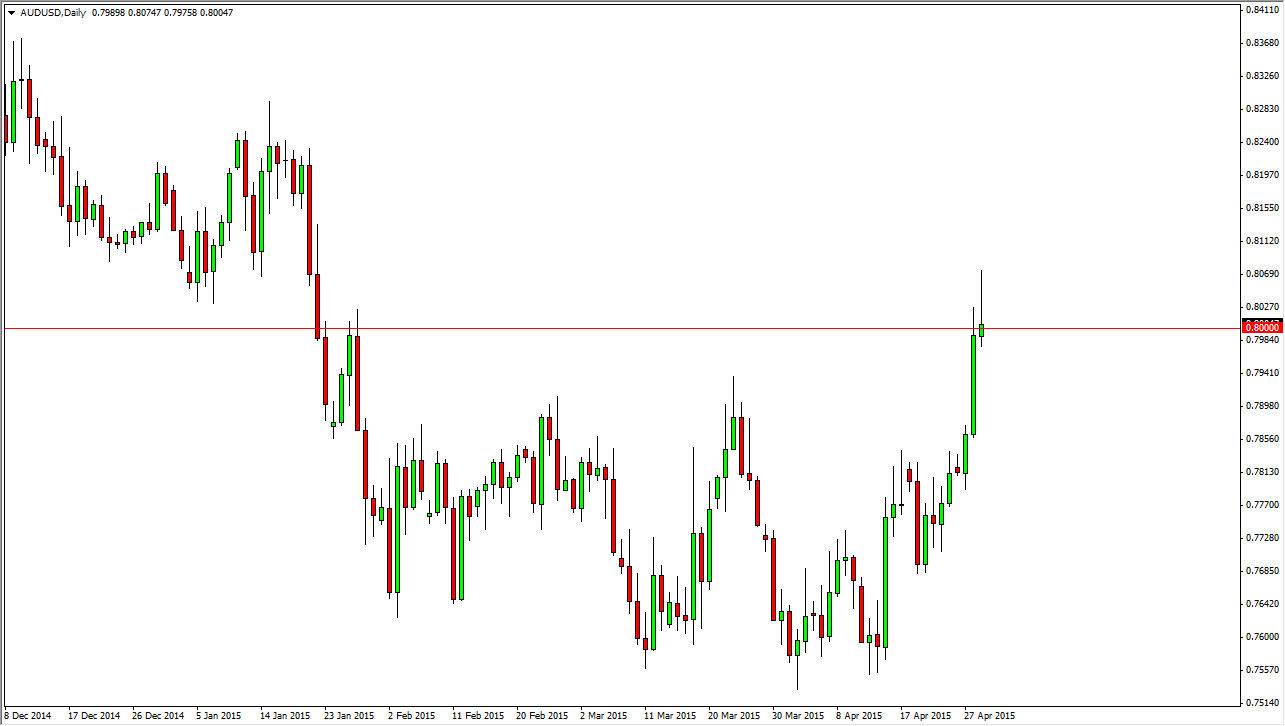

The AUD/USD pair formed a perfect shooting star during the session on Wednesday, after initially breaking out. The fact that this shooting star formed right at the 0.80 level has me intrigued, as it could be a very bearish sign. After all, this is a market that has respected this level more than once on the longer-term charts, so it would not surprise me at all to see the sellers step in here. I believe that a break down below the bottom of the shooting star would send this market looking for the 0.7550 level at the very least. I think that the Aussie dollar may find itself in a bit of trouble, because the gold markets are not helping at all. They did not look that hot during the session, especially after the Federal Reserve statement came out with almost no change.

A lot of volatility, still in a downtrend

There was a lot of volatility during the session here on Wednesday, but at the end of the day not a lot changed. This is especially true with commodity currencies, as both the Aussie and the New Zealand dollar showed signs of exhaustion. I believe that this market is going to fall mainly because the Aussie dollar was more or less rising upon the US dollars expectations more than anything else. This was not something to do with the Aussie itself. So in other words, it was winning by proxy.

This is a market that has been in an extreme downtrend for quite some time, and a significant bounce had to happen sooner or later. I see quite a bit of resistance all the way up to the 0.82 level, and have been stating that I could not buy this market until we clear that level. This candlestick has confirmed that in my opinion, and as a result I will not hesitate to sell if we can break down below it. With that, I am very interested in this market all of a sudden.