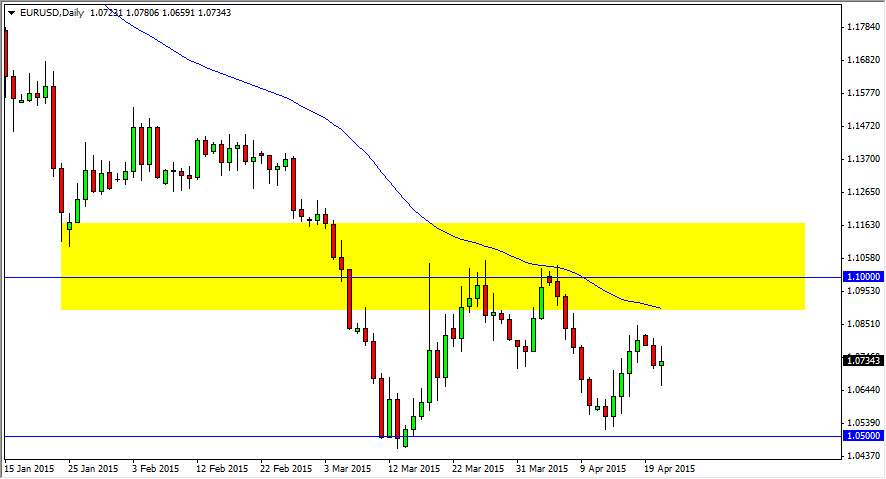

The EUR/USD pair had a fairly volatile session on Tuesday, but at the end of the day really hadn’t changed much. With that being the case, it appears that the market although bearish isn’t quite ready to make a significant move. I certainly wouldn’t be buying the Euro at this point though, and on the chart that I have attached to this article you can see that the yellow box still represents the resistance “zone” that I have been paying so much attention to.

Also on the chart is the 100 day exponential moving average, and as a result I believe that the market still has plenty of longer-term traders selling this pair. I think there is simply a culmination of too many bearish reasons to think about buying the Euro at this point in time as the Greek situation still remains the same as it has been for several years. Ultimately, the debts will not be paid, it’s a simple math problem.

Selling rallies

I continue to say that I am selling rallies in this pair, and that has been working for quite some time. I’m not looking for some type of massive move at this point in time, but I do think that we head down to the 1.05 handle. Looking around the Forex markets though, I cannot help but notice that many of the EUR related pairs look a bit stagnant at the moment. We might have a couple of quiet sessions before we get some type of impulsive move.

I think eventually we will break down below the 1.05 level, and head to my longer-term target of parity. It is going to take a significant breakdown at this point to push the market lower though, so don’t be surprised that even if we do head to the 1.05 level, we will more than likely see buyers down there. Ultimately though, I have no scenario at this point in time where I’m even considering buying this market as the US dollar continues to strengthen against most currencies. With all of Europe’s problems, it’s hard to imagine that it would be the outlier.