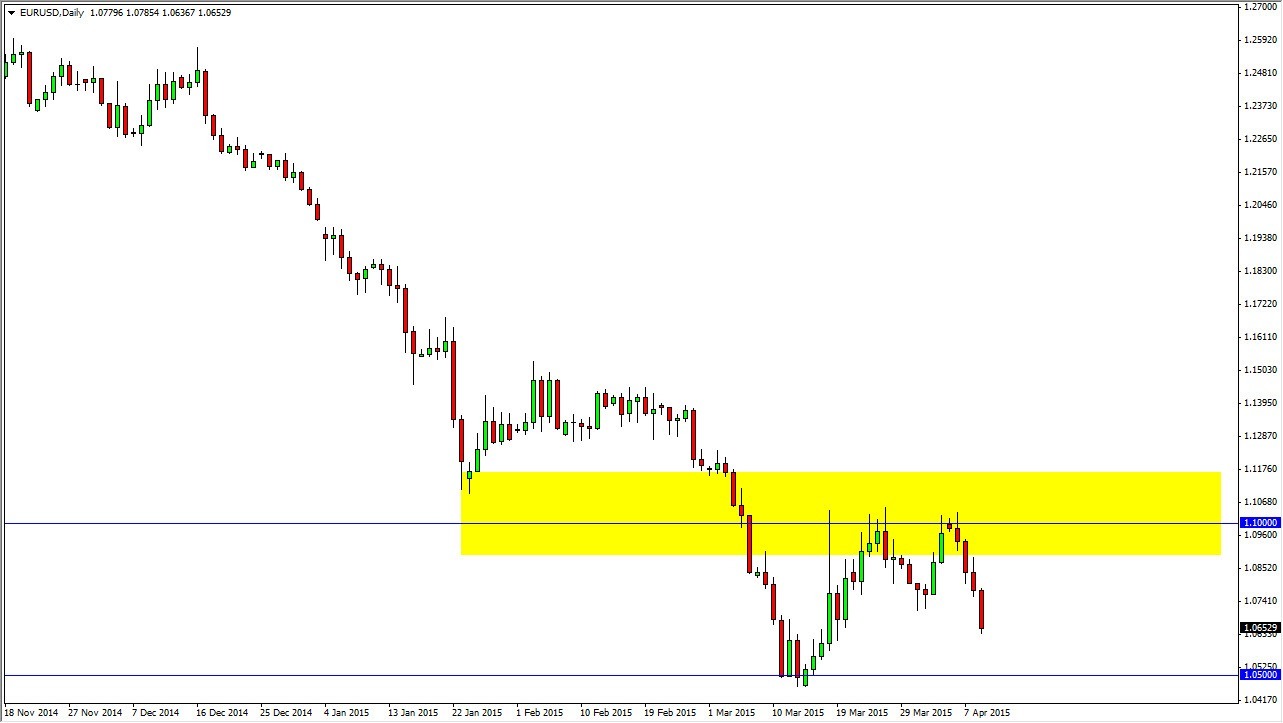

The EUR/USD pair fell hard on Thursday, slicing through the 1.07 level. This market should continue to struggle overall, and I think we are going to head to the 1.05 level. This is the massive support barrier that kept the market afloat last time, but it is probably only a matter of time before we break below there. The market would then go to parity in my opinion. The parity level will of course offer significant bounce, which should be impressive. However, the market will continue to offer selling opportunities on the short-term charts, and this should be the best way to trade the EUR/USD pair: shorting off of the short-term rallies.

The US Dollar should continue to be preferred in general, and this should show itself in this pair. This pair of course runs opposite of the US Dollar Index, and that market looks ready to break out to the upside overall. The market is certainly a “one way affair” at the moment.

Selling rallies over and over

Rallies should continue to be interesting overall, and I plan on using them for entries. I think this pair should continue to offer profits for the sellers every time there is a headline out there. Simply put, the market is too worried about Europe to see any sustained upward momentum in this market. The US dollar will be bought over and over as there is a lot of concern about global markets as well. The “safety aspect” of this currency should continue to keep the bulls on their back foot.

The 1.10 level continues to be massively resistive, and I think this market will continue to respect it overall. This is the top of the range that I am looking at, with the bottom being the 1.05 level. The pair should continue to be stuck in this 500 pip range for a while, but ultimately we go lower. It isn’t until we clear the 1.15 level that I think I will consider going long.