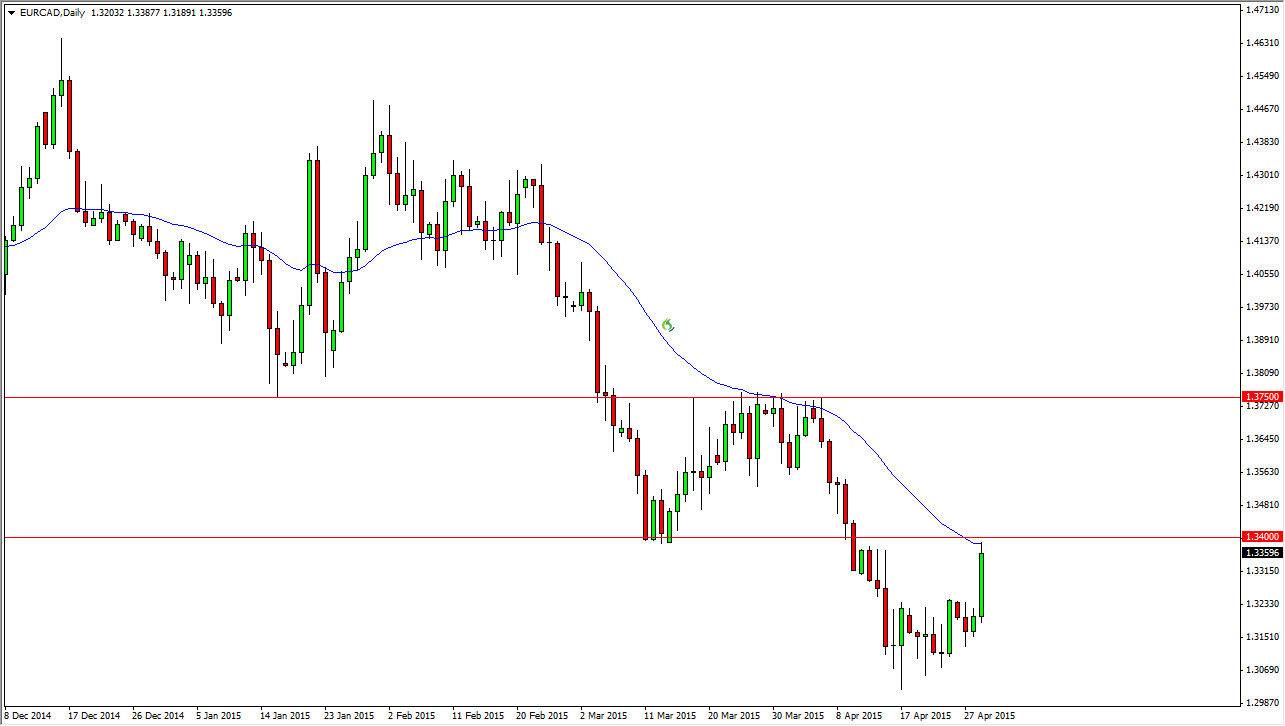

The EUR/CAD pair broke higher during the course of the session on Wednesday as the euro itself took off to the upside. This was predicated mainly upon weakness in the US dollar, but as you can see we have a couple of interesting things happening at one point now. The 1.34 level was previously supportive, and then offered resistance. We are approaching that level again, so therefore there should be a little bit of resistance here. On top of that, we have the 34 EMA just above, while not necessarily a major EMA, it is one that followed by people who believe in Fibonacci sequence.

The candle is very bullish though, so I would be a bit hesitant to sell right away. I think you need to see some type of resistive candle on the daily chart in this region to start selling. It’s going to be difficult to decide whether or not this trade makes sense and until we finish the day in my opinion. After all, the Canadian dollar could find itself on its back foot against the US dollar, so this could come down to the EUR/USD pair deciding the value the Euro itself. There’s a lot of moving parts right now, and to add more drama to the mix, the oil markets are facing significant resistance as well.

Overall downtrend

All that being said, we are in an overall downtrend. You cannot overlook that, as it is probably the most important thing to notice in this market. I think if we find a resistant candle, I would not hesitate to start selling as I think we could move the market back down to the 1.30 level with relative ease. If we break out and form a very positive candle I think we will then try to get to the 1.36 level, and then the 1.3750 level, which of course was resistance previously. Although I see a move coming, it’s going to have to wait 24 hours or so to see what that move is going to be.