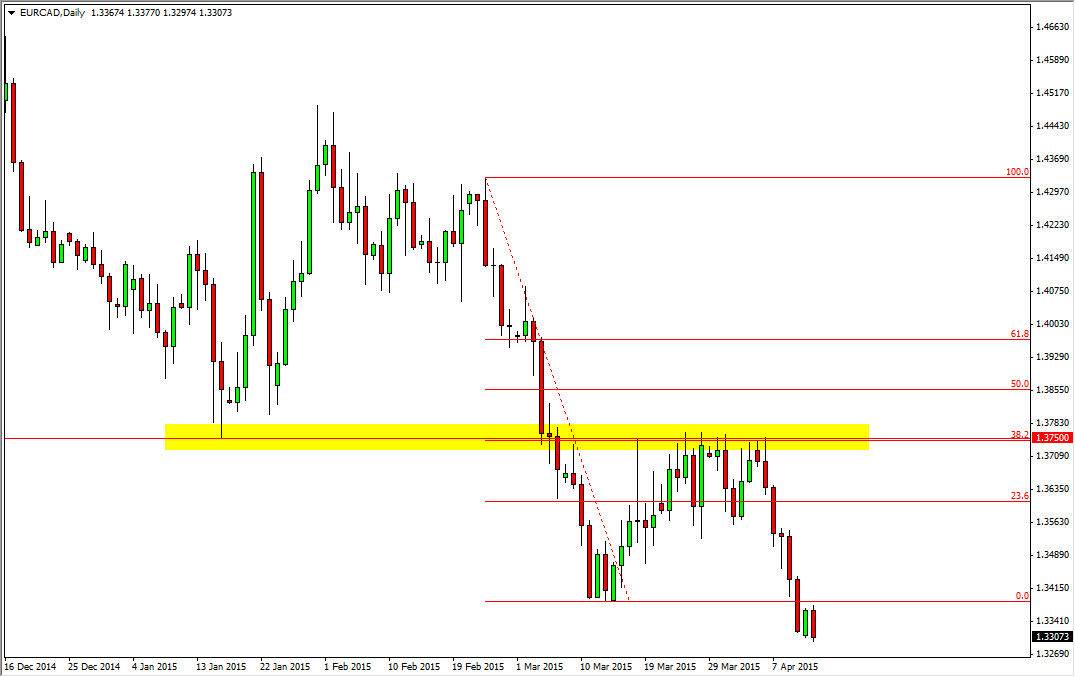

It’s been a minute since I checked out the EUR/CAD pair for you readers, but as you can see we did in fact selloff at the 1.3750 level that got me so bearish in the first place. On Monday, we ended up seeing quite a bit of bearishness play out again, as we made a fresh, new low. I’m not a big fan of the Canadian dollar general, but it does look like it is going to gain a little bit of strength against the US dollar. With that in mind, and the fact that the Euro continues to look very soft against most currencies, it doesn’t surprise me at all that this pair fell to the 1.33 handle during the day.

I think it’s only a matter of time before we break down below that level, and continue going much lower. On a break below the 1.33 handle, I am a seller and aiming for the 1.30 level. I recognize that anyone rise in the value of oil will certainly push this pair down, as the Euro is one of the least favored assets out there right now.

Selling rallies too

I believe in selling rallies two, as this market continues to show bearishness. The selloff recently has been very strong, and as a result it would not surprise me to see you rallies from time to time as a simple function of “backing and filling.” I think that the 1.30 level could get broken below as well, but at this point in time I am anticipating that the market goes down there to coincide with parity in the EUR/USD pair. Keep in mind that although the Canadian dollar is of the strongest currency out there right now, the best way to look at this pair is simply “Europe versus North America.” After all, the Canadians have the Americans to sell their products to, while the Europeans are essentially stuck with each other. I continue to sell.