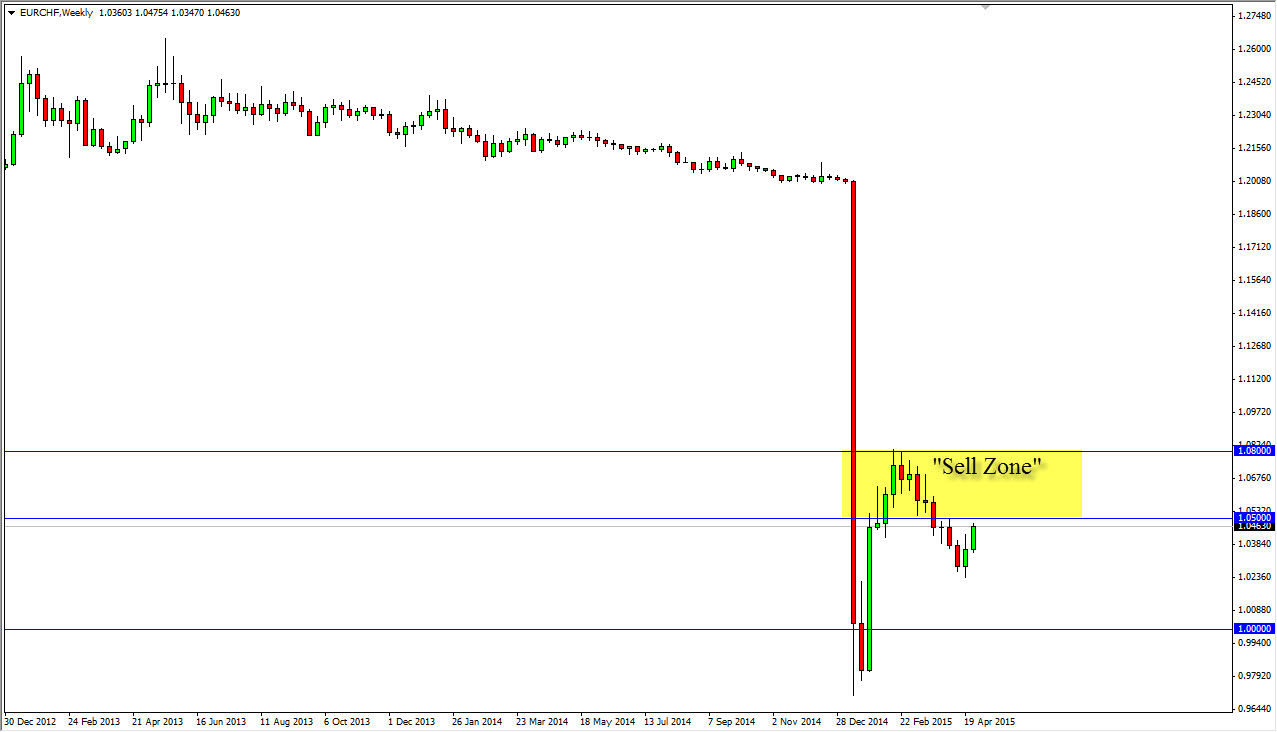

The EUR/CHF pair has had a slight rally over the last couple of weeks at the time of writing, but we are approaching the 1.05 level. The reason I bring this up is that it’s a large, round, psychologically significant number, but it is also an area that has offered resistance before. However, I look at this is a chart that has a resistance zone, and not resistance line.

On the attached weekly chart, you can see that I have a yellow box that extends from the 1.05 level to the 1.08 level. With this, I am looking to sell this pair somewhere in that general vicinity. The question becomes whether or not we can break above the 1.08 handle as to whether or not I would even think about buying this pair. While I do see the Swiss franc losing ground against most currencies, I think this particular pair might be a bit different. After all, it is the epicenter of everything bad involving the Swiss franc. Or rather yet, I should perhaps say the Swiss franc pairs?

With this, I am looking to see if I can get some type of resistive daily candle to sell this pair. I think that we will continue to find the 1.08 level to be a bit of a ceiling in this market, and I do recognize that if we get above there that would be a significant breakout. However, when you look at the Swiss franc related pairs, this is by far the worst performing one out there. This makes sense of course, as there is so much trouble in the European Union at the moment, and this of course was the epicenter of the currency peg breakdown that we saw just several weeks ago.

I’m not a big fan of owning the Euro, and I believe the reason that the Swiss franc is starting to lose value against the many other currencies is the European Union itself. This is because the Swiss are so heavily intertwined economically with the Europeans. However, the simple question is which country would you rather invest in, Switzerland, or some European Union member?