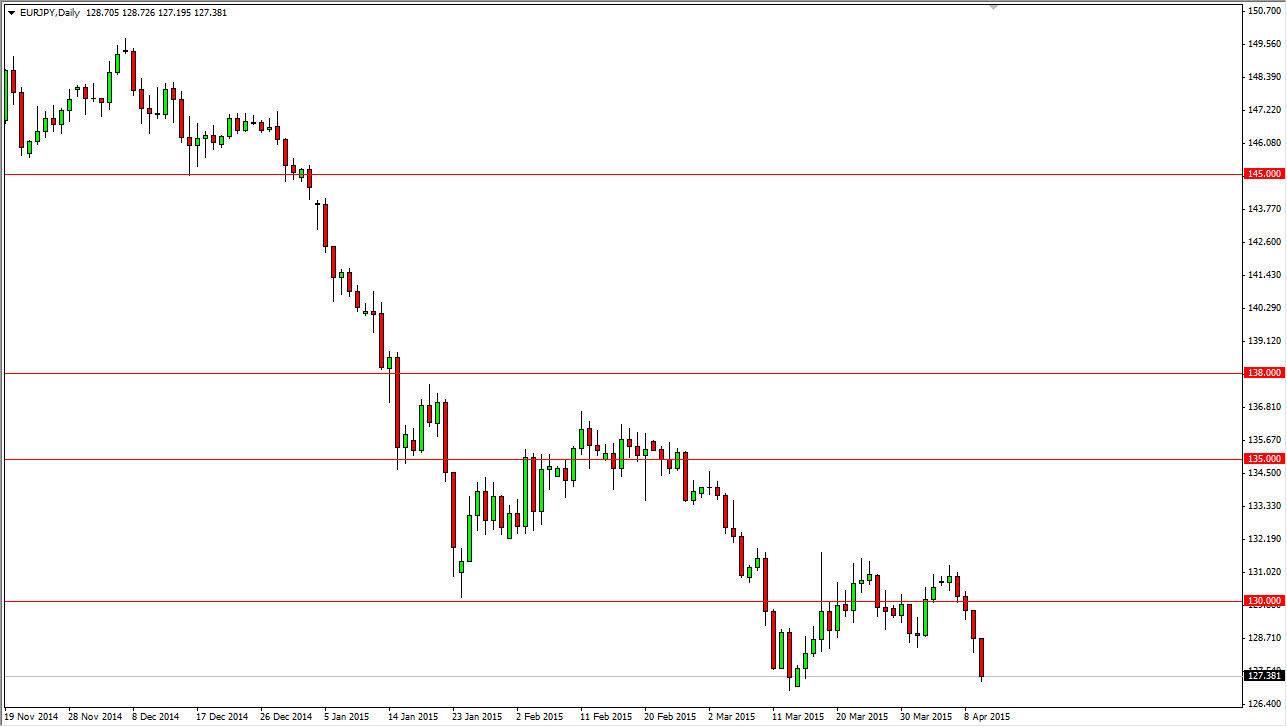

The EUR/JPY pair fell hard during the session on Friday, testing the 127 region. This begins to offer the possibility of the market going even lower, and the fact that we close towards the very bottom of the range of course suggests that the sellers are in fact in complete control. I have no interest in buying this pair even though I recognize that we could possibly bounce from this general vicinity because it was the low previously. However, the way I look at this pair is that you can only pay attention to the Euro and the fact that it is struggling so much. Keep in mind that the Japanese yen is considered to be a safety currency, so quite frankly as long as there’s trouble in the European Union, I believe that this pair will continue to favor the Yen anyway.

Selling rallies and breakdowns both

I’m looking to sell rallies as they appear, because I believe that the market will continue to punish the Euro for European Central Bank liquidity measures, and the fact that the European Union is kind of a mess anyway. I also believe that the 130 level above is massively resistive, so it’s difficult to imagine that the market could go too much farther than that anyway.

I think rallies will continue to go attract sellers, because quite frankly the market has been so one-sided. It has been for some time, and I believe that it’s only a matter of time before the sellers would step back in on any rally. I also believe that if we can break down below the 127 level, it’s only a matter time before we head down to the next large, round, psychologically significant number: 125. That area of course could be a bit supportive, but at the end of the day I think that the writings on the wall. Keep an eye on the EUR/USD pair, because as long as it falls, it shows you that the Euro is still in trouble and should continue to fall against other currencies as well, this market included.