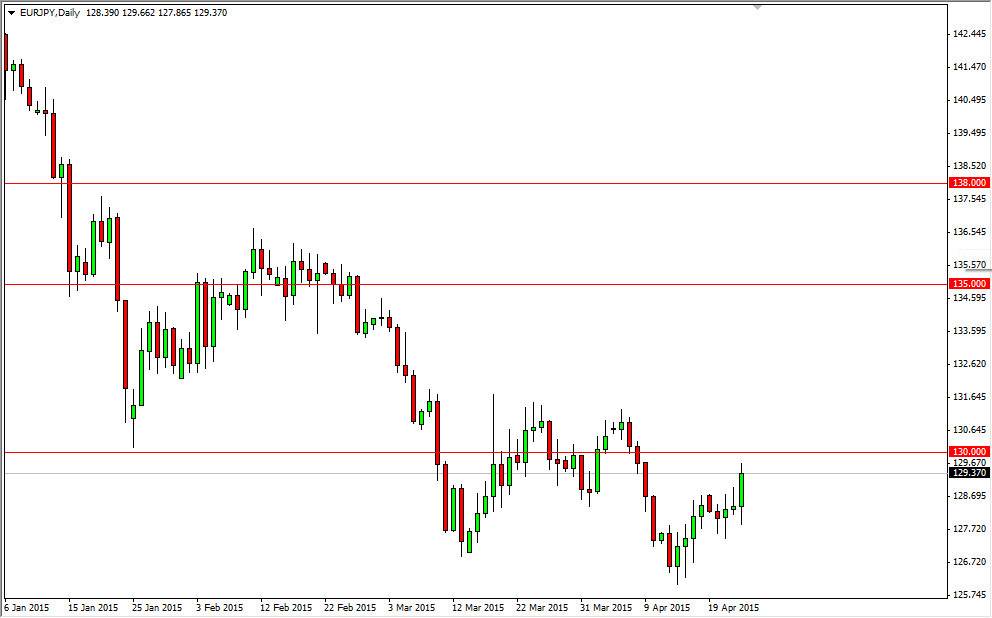

The EUR/JPY pair initially fell during the day on Thursday, but like most other euro related pairs, found buying later in the day. With that, we went much higher and broke above the short-term resistance that the market had been struggling with over the last several sessions. It looks as if we are heading towards the 130 handle, which is a significant round number.

I also believe that there is significant resistance all the way to the 131.50 level, as this is a major “zone” of resistance. In other words, it is a very significant barrier to overcome. The easiest way to trade this market as far as I can see is to wait for a resistive candle in order to start selling again. I do not like buying the Euro, and with this I will wait until I get that opportunity. If you are to buy this pair now, you are simply buying into resistance.

Longer-term perspective

It isn’t until I see the Euro take off against several other currencies for significant moves that I would consider buying this particular pair. After all, the European Union continues to struggle overall, and the Japanese yen is without a doubt a significantly safe currency. With this, I think the market will continue to favor the yen at the end of the day, and that it’s only a matter of time before sellers come back in and make this obvious.

Having said that, if we get above the 131.50 level, the market should then go to the 135 handle. I think that the area in that region is even more resistance, so quite frankly I have no interest in going long of this pair at all at this point. With that, I am very bearish of this pair and they do anticipate seeing this market head back down to the 125 handle given enough time. Ultimately, think of this as momentum building to break down.